What’s the best way to teach your youngster about saving and the power of compound interest?

Everybody knows you march your kid straight down to the local bank or credit union and open up a traditional savings account. Right? That’s certainly the conventional wisdom.

In fact, opening a savings account for your 6 year old is the “official” wisdom too. So says the panel of financial experts who make up the United States President’s Advisory Council on Financial Capability. It’s item 8 on their list of 20 things kids need to know to live financially smart lives.

My take? That’s complete bullcorn.

Let’s just think about this from a 6 year old’s perspective for a moment:

- I got this awesome $20 birthday check from grandma.

- You marched me down to some random building and left my check there.

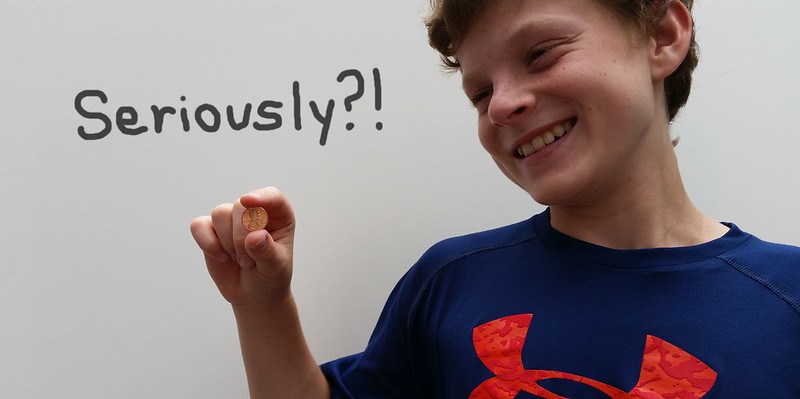

- A year later (also known as an eternity to a 6 — now 7 — year old), you told me (if you actually remembered) that I made a penny (if that) in interest. So I now have $20.01 in some fancy “account” that I never see. Big whoop!

- This “savings” thing is a total rip-off. Next time I’m going to tell grandma to just quietly slip me some cash so I can spend it right away before you stuff it in that black hole you call a savings account. Oh yeah, what’s that thing you were calling compound interest? Why is that important again? Oh never mind...

Doesn’t sound too compelling to a 6 year old, does it?

So if a traditional savings account isn’t the right answer for your kids, what is?

Parent-paid compound interest from the Bank of Mom/Dad.

Run your own little mock family bank at home where you define the compound interest offering using amounts and time-frames that are actually interesting to a kid. It’s a technique I first saw described in the book The First National Bank of Dad by David Owen. More recently, the popular personal finance blogger Mr. Money Mustache wrote about the same system in his post: What I’m Teaching my Son about Money.

How does it work? The parent acts as the banker and maintains a pseudo bank account for the child using pencil and paper, a spreadsheet, or an automated online app like FamZoo. The current balance represents how much the parent (the bank) “owes” the child. Mr. Money Mustache describes the day-to-day operations this way:

To make a deposit, he just hands me some cash. To withdraw, he asks me for cash or has me buy something for him online. But for every dollar that remains in the account, he accrues interest at a 10% annual rate with monthly compounding.

That last part is the parent-paid compound interest. Now we’re talking something way more interesting than a penny a year. In fact, Mr. Money Mustache says his 9 year old’s “$600 account is now bringing in a very tangible $5 per month in interest.” Cha-ching!

The awesome power of compound interest will definitely sink in when your kid’s seeing that kind of dough roll in each month. In fact, you may want to cap it so things don’t get too out of control. After all, the Bank of Mom/Dad isn’t too big to fail, which is an entirely different lesson...

Wondering what other parents are paying in compound interest and how often? Here are the average interest rates currently being paid by FamZoo families grouped by compounding period:

- 0.74% compounded weekly

- 2.12% compounded monthly

- 6.51% compounded yearly

By the way, weekly compounding is by far the most popular. 70% of the interest bearing accounts pay interest weekly, 27% pay monthly, and just 3% pay annually. Don’t underestimate the power of repetition when it comes to building a habit.

Whichever compounding frequency you choose, be sure to notify your child (and celebrate) every time an interest payment rolls in. Remember: out-of-sight means out-of-mind; so keep the regular dialog going.

If you keep your little family bank humming for a few years, then someday down the line when somebody asks your grown kid: “what’s the one thing wish you had learned about money growing up?” — the power of compound interest definitely is not going to be the answer like it is for so many adults today. Check out my recent post, 81 Money Lessons Your Kids Will Wish You Had Taught Them 25 Years From Now, and you’ll see what I mean.

You can bet a kid making upwards of a buck a week in parent-paid interest is going to “get” the power of compound interest pretty darn quickly.

And that’s no bullcorn.

P.S. if you’d like to hear an audio version of the parent-paid compound interest concept, check out the short excerpt from a recent podcast below. (Or click here if you’re reading this post in an email.)

Newer Post

Newer Post

9 comments:

This is a great concept but not reality. The parent account will set the child up for a false interest expectation. Instead, teach the child different savings options/investments that will yield different results and then let him decide which one to try.

David,

Thank you for stopping by and sharing your point of view. Two things to consider:

* Many of the options/investments available to adults are not readily available to kids in a simple or hassle-free form. For example, one of my favorite investments - low cost market index funds - have fairly high minimums and would require you to set up a custodial account, etc. So, you might consider creating a parent-paid interest account in which the interest rate roughly matches one of your favorite adult oriented real world investments. You might also deliver the interest payments more frequently since kids tend to operate on a faster clock. The frequent payments will also prod you to have a conversation regularly with your kid about the "underlying" investment to which you've pegged the payment. I've found that most kids require a lot of repetition for the concepts to thoroughly soak in. Note: once your kid's parent paid interest account grows to a reasonable size and clears a minimum investment hurdle, that's a good time to roll it over into a real-world custodial account.

* An interesting Harvard study was done on using incentive payments for educational performance. It found paying for grades (the ultimate outcome) to be ineffective. However, when they paid along the way for the study habits that LED to good grades (reading each night, etc.), it was effective. Not only that, the positive outcomes persisted AFTER the payments stopped. Why? Good study habits were formed and they stuck. That's what we're trying to accomplish here: pay an attention-getting interest rate while the kids are young in hopes that the habit will form and stick though adulthood - even after the "unrealistic" payments cease.

Cheers,

Bill

Great thread. Agree with David that it's not how it works in the real "adult" world. But then neither is 90% of all the other things we do with our kids as parents to get them ready for the real world. Think diapers, pureed food, etc etc. The point is to get them ready for reality, not crush them (or us) with it. Seizing learning opportunities that are accessible now, and building on them over time, is manageable to both the parent and the child. Good habits and a high dose of creativity will set them up for success in the real world. No doubt.

We've been using the "parent" interest for a few years now. My oldest son uses his interest to pay for his cell phone monthly. When his balance is too low to earn enough interest to pay his bill, he knows that he needs to work more around the house to earn money for his balance. I don't know if it has taught my kids to save, but it has taught them the following:

1) There are ways to let your money work for you and not the other way around. They understand the concept of interest and the importance of maximizing your interest. Very few 10 and 12 year olds know this.

2) In order to make any real amount of money, you have to save to at least a minimum balance. Interest is great, but its a percent of a number. You save to get to that number and you have to maintain that number if you want to keep generating interest.

3) I won't pay for their cell phone bill (my favorite lesson:).

Its a very effective tool. I highly recommend it.

Bill -- I've set up the cards for all the accounts, and we're all set to get started -- 2 week vacation coming up and we'll sit down with the kids one night to go over the plan/talk about interest, etc. Two quick questions (that might be a good blog post subject if you haven't already covered them/I didn't see them). One: what do you do with the $20 check from grandma? Have the kids sign it over to you (can they do that legally, if they are 11 and 14?), and then you deposit that much money in one of their accounts? Two: any good ideas for gift cards (amazon, itunes, etc.). I'd like to take the card numbers and put them into virtual accounts for them that they can see, and remember to use them (it's amazing how they collect dust in a bag and you forget to use them). Thanks for this amazing tool.

Alex,

Thank you for joining FamZoo and for your kind words.

As for depositing checks for minors, this BabyCenter post has some good info:

http://community.babycenter.com/post/a3373225/checks_made_out_to_your_child

(Personally, I have always just had my kids endorse the check and then deposited it at the ATM. I bank at one of the biggest 5 banks in the US and never had a problem over the last 20+ years and 5 kids. I doubt I'm "special" to them. Of course, your mileage may vary!) After absconding with their birthday checks, I of course credit their FamZoo accounts accordingly. I don't even charge a fee for this wonderful check cashing service :-)

That's a good idea for tracking the gift card balances with individual IOU accounts - we've heard of other families doing that too. Two suggestions:

1) You might enable child permissions on the IOU accounts for each card so your kids can be responsible for recording the spending transactions as they happen. See: http://blog.famzoo.com/2010/07/teach-your-kids-how-to-track-expenses.html

2) You can hide the accounts once the cards are all used up to keep things uncluttered over time. See: http://blog.famzoo.com/p/famzoo-faqs.html#hide-account

Thanks again for your comments,

Bill

Hola. Saw a reference to "using the Famzoo site" to calculate the weekly interest payments.. but I cannot find this feature. Also, is there a mechanism where this can be automated (once the feature is revealed to me)?

Thank you!

Here's the FAQ entry that explains how to set up automated parent-paid interest on a FamZoo IOU or prepaid card account: http://blog.famzoo.com/p/famzoo-faqs.html#interest

That's what I was looking for; thankee!

Post a Comment