FamZoo delivers prepaid cards and a financial education for kids.

All in one award-winning family finance app.

FamZoo is designed specifically to:

1. Save busy families time and hassle when managing money.

2. Teach kids critical financial skills through hands-on experience.

Here are just a few of the key capabilities in each area.

For a full list of FamZoo capabilities, browse our FAQs

| Family Convenience |

|

Parent/Child Roles

Parents control accounts and money rules. Kids see just their own accounts with controlled access.

Details

|

|

Instant Transfers

Move money instantly between family member cards.

Details

|

|

Scheduled Transfers

Automate recurring transfers between family member cards - e.g., allowance.

Details

|

|

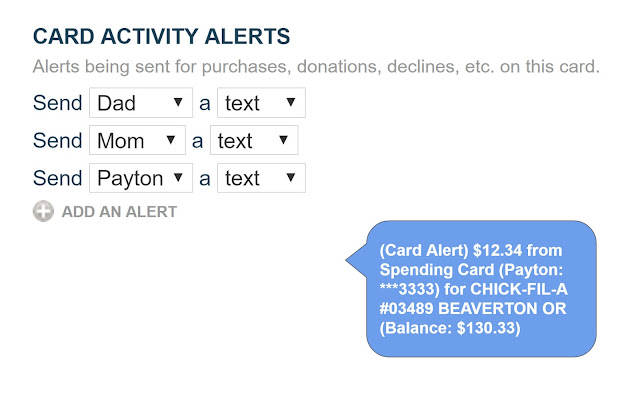

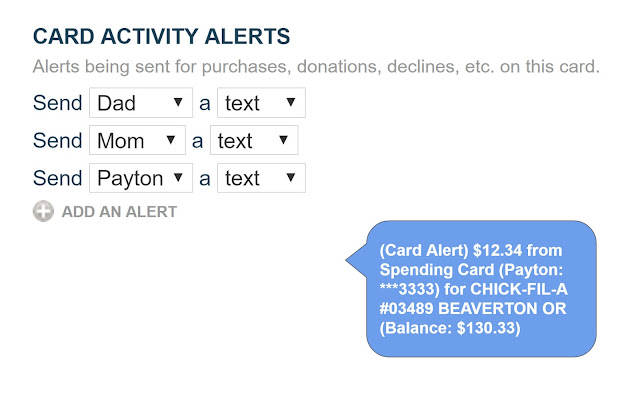

Activity Alerts

Alert parents and children about card activity and remaining balance in real time.

Details

|

|

Lock/Unlock Card

Temporarily prevent use of card for protection or for a “financial time-out”.

Details

|

|

Money Requests

Automate approval and tracking of requests for money.

Details

|

|

Reimbursements

Automate approval and tracking of expense reimbursement requests.

Details

|

|

Detailed Decline Info

See specifics on why each decline occurs and what action to take.

Details

|

| Financial Literacy |

|

Payment Checklists

Schedule chores and odd jobs tied to rewards or penalties.

Teach kids the value of a dollar and the connection between money and work.

Details

|

|

Spend, Save, Give Accounts

Separate funds into multiple purpose-driven accounts.

Teach kids to assign a purpose to each dollar with simple envelope budgeting.

Details

|

|

Payment Splits

Split payments for allowance, chores, odd jobs, etc. between multiple accounts.

Teach kids to withhold savings and donations before spending. Pay yourself first!

Details

|

|

Parent-Paid Interest

Define and automatically pay your kids an “interesting” savings interest rate.

Teach kids the power of compound interest in a time-frame they can appreciate.

Details

|

|

Savings Goals

Set savings goals, make savings projections, and track progress.

Teach kids to set, track, and achieve financial goals.

Details

|

|

Family Billing

Schedule automated debits to charge kids for their share of recurring family expenses.

Teach kids that typical shared family services like cell phone data plans are not free.

Details

|

|

Informal Loan Tracking

Track the repayment of money loaned to kids with a parent-defined loan interest rate.

Teach kids that borrowing money costs money and impacts other priorities.

Details

|

Parent/Child Roles

Parents control accounts and money rules. Kids see just their own accounts with controlled access.

Instant Transfers

Move money instantly between family member cards.

Scheduled Transfers

Automate recurring transfers between family member cards - e.g., allowance.

Activity Alerts

Alert parents and children about card activity and remaining balance in real time.

Lock/Unlock Card

Temporarily prevent use of card for protection or for a “financial time-out”.

Money Requests

Automate approval and tracking of requests for money.

Reimbursements

Automate approval and tracking of expense reimbursement requests.

Detailed Decline Info

See specifics on why each decline occurs and what action to take.

Payment Checklists

Schedule chores and odd jobs tied to rewards or penalties.

Teach kids the value of a dollar and the connection between money and work.

Spend, Save, Give Accounts

Separate funds into multiple purpose-driven accounts.

Teach kids to assign a purpose to each dollar with simple envelope budgeting.

Payment Splits

Split payments for allowance, chores, odd jobs, etc. between multiple accounts.

Teach kids to withhold savings and donations before spending. Pay yourself first!

Parent-Paid Interest

Define and automatically pay your kids an “interesting” savings interest rate.

Teach kids the power of compound interest in a time-frame they can appreciate.

Savings Goals

Set savings goals, make savings projections, and track progress.

Teach kids to set, track, and achieve financial goals.

Family Billing

Schedule automated debits to charge kids for their share of recurring family expenses.

Teach kids that typical shared family services like cell phone data plans are not free.

Informal Loan Tracking

Track the repayment of money loaned to kids with a parent-defined loan interest rate.

Teach kids that borrowing money costs money and impacts other priorities.