Keep it simple, stupid. Keep it short too.

I was reminded of the famous KISS principle while reading Ron Lieber’s recent New York Times Your Money column about distilling your financial to-do list to a set of bullet points that fit on a 4 by 6 index card.

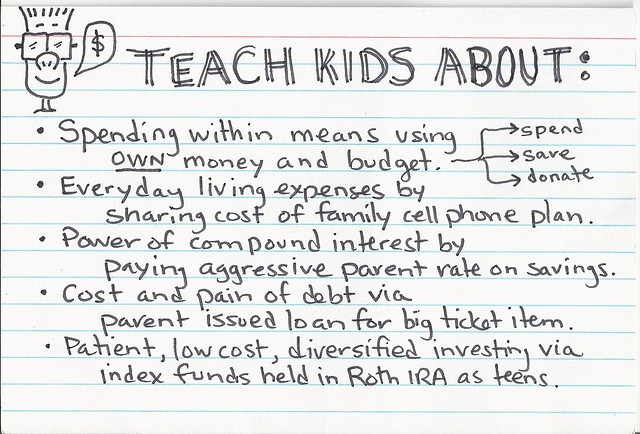

The examples in Ron’s article inspired me to produce this variant: a “Money Mentor Index Card” listing the key things I want to teach my kids about money. Here’s the list.

I want to teach my kids about:

- Spending within their means using their OWN money and budget. (Note: the budget includes saving and donating too!)

- Everyday living expenses by sharing in the cost of the family cell phone plan.

- The power of compound interest by paying them an aggressive parent rate on savings.

- The cost and pain of debt via a parent-issued loan for a big ticket item, like a laptop or a phone.

- Patient, low cost, diversified investing via index funds held in a Roth IRA as teens.

It’s so short, I could KISS it!

What would you put on a Money Mentor Index Card for your kids?

Newer Post

Newer Post

5 comments:

Your card is a good start Bill. I'd include the power of having a plan for your money and an emergency fund.

Yes, those are two great additions Brian. I had to chop it back a bit for "artistic reasons" :-) I've actually started making all 5 of my kids maintain a separate emergency fund bucket within the last year, separate from my high interest Bank-Of-Dad savings account. It's a terrific habit to start early - even little kids have "emergencies" (like lacrosse balls shot through neighboring windows...)

Love it! Hadn't thought of #4 before, but that totally makes sense. Thanks!

Thanks for stopping by, Robert. Yes, many parents abide by the rule: "never lend money to your kids" for fear that it will teach them to spend money recklessly before they have it. I think that's a good rule for everyday purchases, but paying off a BIG loan occasionally is actually a great learning opportunity and experience. With some prior experience, they won't be caught off guard by (or be complacent with) their first big loan (car/home/student) as an adult.

The earlier the better, its awesome that you are teaching them all this. They will be prepared for the real world and ready to take it on!

Post a Comment