Impulse spending, peer pressure, phishing attacks, sketchy sites, dark patterns. There's no shortage of scary things lurking out there in the financial jungle conspiring to consume the funds on your child's card.

How can you minimize the risk?

Get your child a second spending card!

Question: How in the world can two spending cards be safer than one?

Answer: when they’re part of a Spend Now, Spend Later System.

- One card is a Spend Now card used for purchases. Normally, it’s empty.

- The other card is a Spend Later card that is never used in the wild. It’s a safe holding tank for future spending.

- Transfer the appropriate amount from the Spend Later card to the Spend Now card just in time for purchases.

As long as the Spend Later card never sees the light of day, its funds will be fully protected from impulse purchases, card skimmers, merchant data breaches, phishing attacks, and other bad habits or nefarious actors.

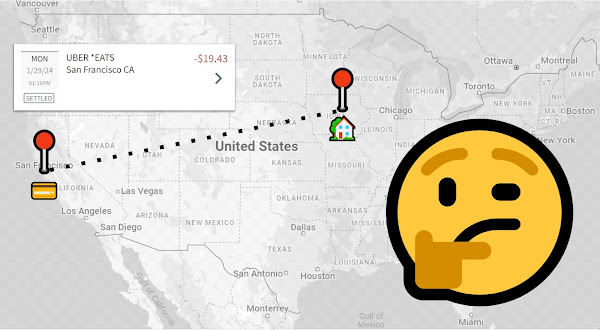

If bad actors do get a hold of the Spend Now card or its numbers, they’ll be disappointed to find its balance sitting at zero. You'll see their futile attempts as harmless declines in the transaction history. Lock the card and order a replacement at the first sign of any shenanigans.

Setting Up The System

Here’s how to get your Spend Now, Spend Later System up and running quickly:

Newer Posts

Newer Posts