Now is the perfect time to sit down with your child and conduct a year-end review of their finances. If delivered diplomatically, a gentle audit will nudge them toward better fiscal habits in the year ahead.

To set the right tone for a candid exchange, I like to break the ice by confessing one or two boneheaded financial mistakes of my own. Like when I wasted a gazillion dollars on an unnecessary storage locker — for 13 years! Hey, we all make financial mistakes, right?

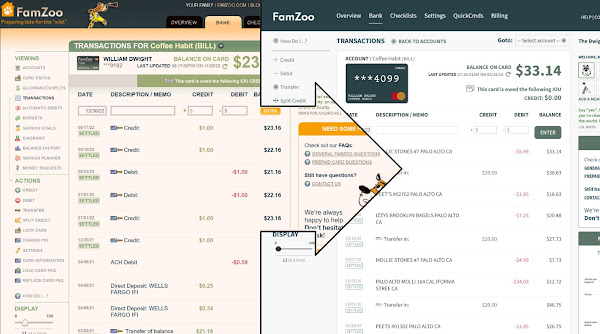

As you browse through your kid’s transactions from the past year together, here are a few things to look for and discuss:

Newer Posts

Newer Posts