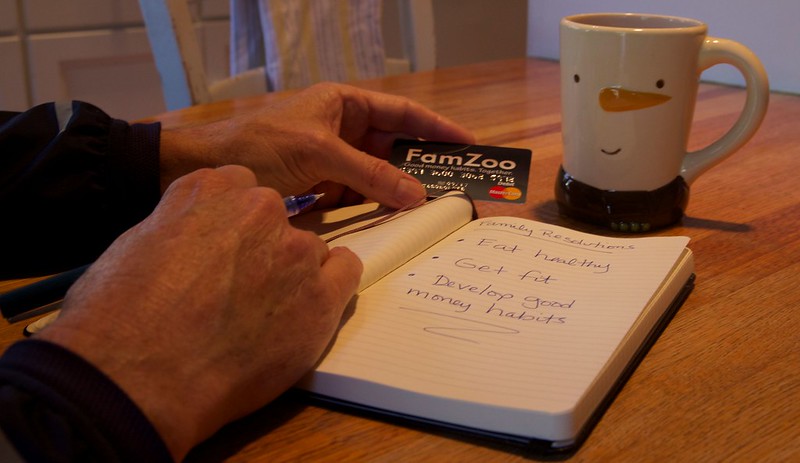

Are you stuffing your child’s savings in a bank account because you’re afraid of the stock market? If so, what do you suppose the annual return after inflation will be? Minimal. In fact, it may be negative.

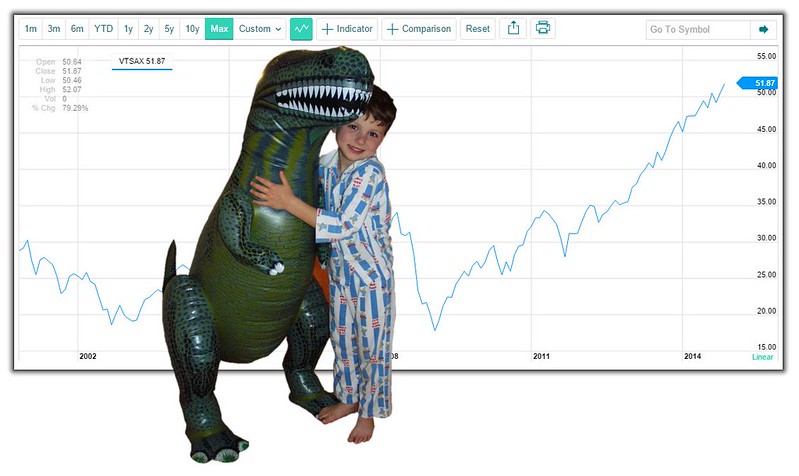

Whether you’re a millennial or not, you might want to check out this excellent article in the Wall Street Journal: The Market Is Your Friend. Really: A Millennial’s Advice to Peers. First, it explains why the fear that millennials (and perhaps you) have about investing in the stock market is quite understandable. Second, it explains why they (and perhaps you) really need to get over it! The bottom line: 6.8%. That’s the average annual return after inflation that the stock market has earned since 1871, and that’s in the face of 29 recessions, 1 Great Depression, 2 world wars, and plenty more disasters. If you’ve got time on your side, you’re going to be hard-pressed to find a smarter long term investing strategy than a low cost US stock market index fund. And, fortunately, time is one thing your kids have in spades!

Newer Posts

Newer Posts