Note: As of December 1, 2021, PopMoney.com no longer supports sending money from their site. It can only be used to receive funds. See here for all currently supported FamZoo reload options.

Prepaid cards are surging in popularity — even among those who already have traditional checking accounts and credit cards. Why? Here are a few key reasons “banked” consumers like using prepaid cards:

- Limit fraud exposure. Nobody can spend more than what’s loaded on your prepaid card. Nobody can use it to run up your debt or clean out the money sitting in your checking account. That makes consumers more comfortable transacting at unfamiliar online sites or potentially “sketchy” establishments. Load a limited budget on the card before making your purchase and set up transaction alerts to keep an eye on activity. If you see something amiss or lose your card, lock it right away, unload any remaining funds, and order a new one. No problem. Replacing a limited-use prepaid card is a lot less hassle than replacing your main bank debit card or credit card.

- Keep spending within budget. Prepaid cards are a modern upgrade to the classic cash envelope budgeting system. Instead of stuffing cash in an envelope labeled “Clothing”, load your monthly clothing budget onto a separate prepaid card. That way, you can make purchases just as easily online as in stores. It’s the convenience and protection of a credit card, without the risk of overspending.

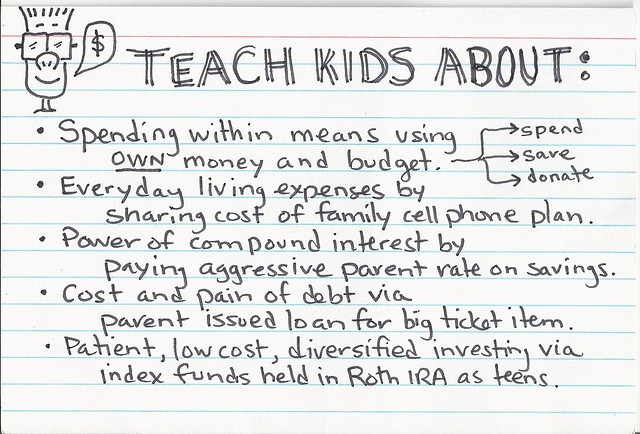

- Manage allowance and chore money. A prepaid card is a convenient, safe way to put money in your kid’s hands: no fumbling with small change, easy to use online for gaming subscriptions or purchases, easy to lock and unload funds if lost or stolen, automatic audit trail, and no risk of running up a debt. Much better than cash. Certainly much better than letting your kid use your credit card. An excellent warm-up for adult banking products.

Cool. So how do you load money onto your prepaid card from your checking account?

Newer Posts

Newer Posts