You’re looking for just the right financial setup for your teen.

Not too simplistic: learning is the goal. You want your teen to master critical money management skills before leaving the nest.

Not too sophisticated: no need to boil the ocean here. Don’t create a monster your teen hates and you can’t manage. You’re a busy parent. Having helped raise 5 teens, I get it.

For the sweet spot, I recommend a 4 bucket system with card accounts for:

- Everyday expenses

- Saving

- Charitable giving

- Clothing expenses

(Note: if your teen could care less about clothing, pick some other budget category that they really care about: sports, music, art, gaming, whatever.)

When ordering cards, click/tap Add Card next to your teen’s entry to add each of the four cards. Fill in the custom label line with the corresponding short description above (or similar) and select the appropriate spend / save / give category for each.

When the cards arrive:

- Activate the cards.

- Set a memorable but secure PIN for each.

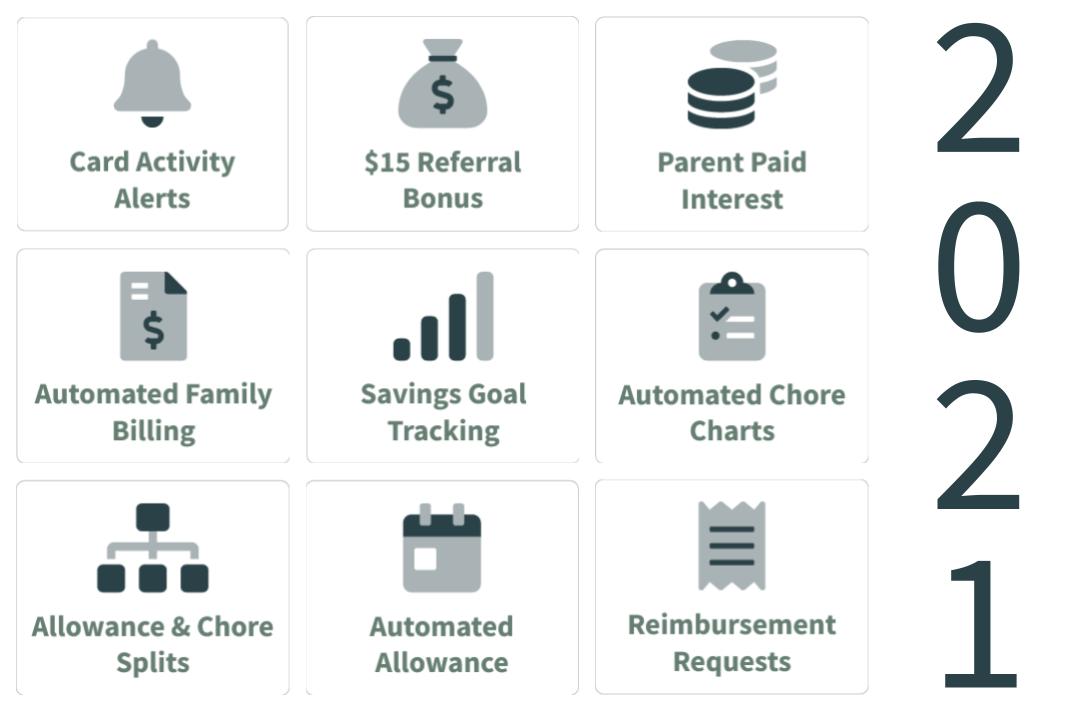

- Create a modest weekly allowancethat splits the amount between the first three accounts.

I recommend discussing the split percentages with your teen to come up with a reasonable allocation, but 80% / 10% / 10% is a good place to start. You can always adjust the ratios later.

How much is a modest amount? That varies by family, but America&rquo;s favorite formula is age-in-years times a dollar. You can tune this as you go too, so a little trial and error is fine. If your teen can buy whatever they want, whenever they want, it&rquo;s too much. If it takes “forever” (teen-speak for a few weeks) to accumulate enough to go to Chipotle or Whataburger with friends every once in a while, it’s too little.

- Add an aggressive parent-paid weekly interest rate to the savings card. FamZoo parents are paying an average weekly rate of 1.5% right now. Cha-ching! Note that you can cap the total amount paid out each time — for example, never more than $3. That way, the rewards don’t get out of control once your teen finally figures out what an insane deal you’re offering.

- Create a monthly or annual clothing allowance that goes 100% to the clothing expense account. You can use a FamZoo budget worksheet to negotiate the appropriate amount with your teen.

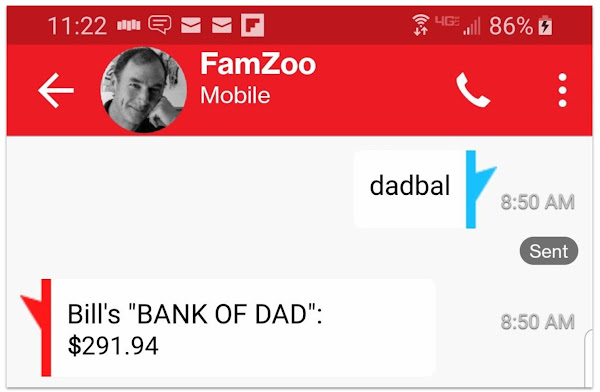

- Set up activity alerts on all cards. Let your teen know you’ll be getting a text for every transaction too. That’s a great way to head off potential shenanigans at the pass. It’s also an easy way for your teen to stay on budget since the notifications include the resulting balance.

- Review this article with your teen: 11 Numbers Kids With Prepaid Cards Need To Know.

- Review this article with your teen: 6 Ways To Guard Your Kid’s Prepaid Card.

- If your teen will be pumping gas, review this FAQ entry: What’s the best way to pay for gas?

- Decide what expenses you are willing to pick up on your teen’s behalf (books, half the gas expenses, school day lunches, etc.). Then, show your teen how reimbursement requests work.

Your teen will learn many critical money lessons with this setup over the years. Here’s a lucky seven sampling off the top of my head:

- How to handle a card responsibly. If things go south, you can always impose a little “financial timeout” by locking the everyday expense card.

- How to monitor for unexpected or unauthorized charges using card alerts.

- How to give every dollar a mission by splitting incoming funds between multiple purpose-driven accounts.

- How to pay themselves first by saving before spending.

- How to harness the power of compound interest.Your teen will eventually realize that money — if left alone in the right place — can make more money through compounding. You’ll know your teen has figured it out when you start seeing transfer requests from spending to savings.

- How to create and manage a budget over a relatively long timeframe. Your teen is also likely to learn how to handle the consequences of blowing through a budget right out of the gates — just like my daughter did with her clothing account.

- How to appreciate the value of a dollar and the humbling cost of everyday items.

That sounds just about right for flying the financial coop.🐥

Newer Posts

Newer Posts