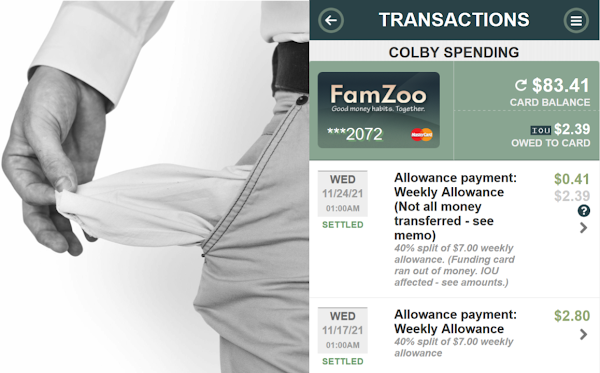

“I need to get more money on my FamZoo card. Right. Now.”

I hear that often from panicked parents.

Good news on that front! Apple just joined the instant reload party.

On August 5th, Apple added instant transfer support for MasterCard debit cards — like ours. I tested it myself the following weekend. Worked like a charm. 99 bucks to my Bank of Dad card instantly for a $1 fee. (Apple has since bumped up the fee from 1% to 1.5%.)

That brings the digital wallet instant transfer support count to three: Apple, PayPal, and Venmo. So, if you have money sitting in any one of those digital wallets, you can move it over to FamZoo within minutes.

All three digital wallets charge a fee for instant transfers: typically 1.5% to 1.75% of the amount, with a minimum fee of 25 cents and a maximum fee of $15 to $25.

Unfortunately, CashApp is the one remaining instant transfer hold out. CashApp doesn’t support linking the FamZoo card as a debit card yet. So, only the slower 1 to 3 business day transfer option is available there.

Here’s a summary of the FamZoo reload support for the major digital wallets:

Newer Posts

Newer Posts