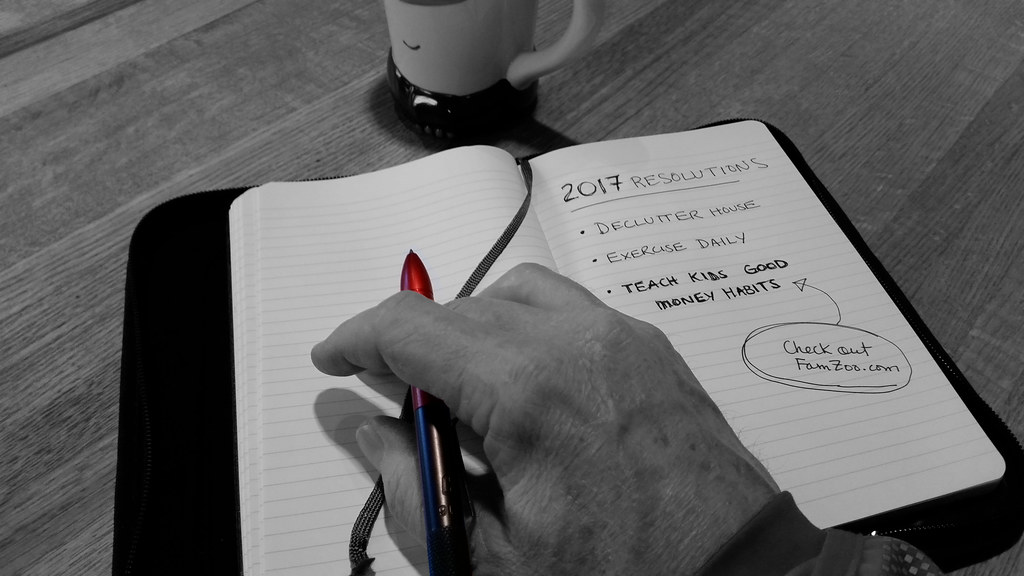

Are you looking for fresh ways to help your kids level up their money skills in 2017?

Last year, I gathered over 300 tips and techniques for helping kids learn how to manage money responsibly. That’s a lot to sift through. So, here are 34 of my recent favorites grouped by age level. They’re all new since my round up of 21 back-to-school money tips in August.

Feeling overwhelmed by the new year already? Just pick one or two to try. Or, tackle one a month.

Youngsters

- Calibrate Chore Payments With Real Data — If you’re compensating kids for chores, here’s some data to help you calibrate your payments.

- Let Your Kids See You Leave Stores Empty Handed — Teach your kids about retail reciprocity tricks so they’ll feel comfortable leaving stores with nothing in their hands and dollars in their pockets.

- Turn Your Kid’s Next Treat Outing Into A Mini Budgeting Lesson — Here’s a short, sweet way to teach your kid a little basic budgeting.

- Let Kids Gift Service Bucks Instead Of Stuff — If you want your kids to be thoughtful gift givers, but you don’t need any more stuff, here’s a solution.

- Turn Why Into How When Kids Whine About Money — How to turn whining into problem solving when your kids want to buy something.

- Let Kids Blow Their Own Money On Gum — Here’s some data to help you handle the classic checkout stand gum gambit with your kids.

- Put A Meaningful Label On Your Kid’s Allowance — What message do you want to send whenever allowance hits your kid’s account? These allowance labels that other parents are using might give you some fresh ideas.

- Help Your Kid Handle A Money Windfall — Discussing how to handle small windfalls (like holiday money!) with your youngsters now might prevent them from blowing big windfalls as an adult. Here are a few strategies to consider.

Tweens

- Make Kids Pay The Sales Tax — Kids often don’t have a clue about how much things cost or that sales tax even exists. Here’s a clever and affordable way to make your kids mindful of both.

- Teach Your Doll Loving Tween About Total Cost Of Ownership — Certain types of purchases start out small but quickly balloon with add-ons. A doll is a classic example. Use it as an opportunity to teach your tween about total cost of ownership.

- Nudge Your Kid’s Charitable Impulses With Giving Data — This data might be the nudge your kids need to up their charitable games in 2017.

- 7 Ways To Help Your Kids Develop Gratitude — Looking for ways to instill a sense of gratitude in your kids? Try some of these ideas.

- Stop Birthday Shopping For Your Kid’s Friends — This birthday present protocol for your kid’s friends will make your child more responsible and thoughtful. It should save you some hassle too. Bonus.

- Fight Financial Bullying With Cards And Alerts — Financially bullied kids can be too intimidated, naive, or embarrassed to let Mom or Dad know. Here’s how you can proactively avoid the situation.

- Teach Kids To Keep A Backup Stash Of Cash On Hand (Or In Shoe) — Sometimes technology fails. That includes financial technology. Make sure your kids always have a payment Plan B.

- Make Kids Journal Their Money Requests — Here’s another way (aside from a budget-based allowance) to put the brakes on impulsive extra money requests from your kids.

- Add Consequences To Allowance With A Chore Fail Chart — Here’s a money system for young kids that can give parents the ease of an allowance without the entitlement and the accountability of a chore chart without the hassle.

- Ding Your Kids For Replacement Cards — Is your kid too cavalier about keeping track of a payment card? Consider this remedy.

- Teach Kids A Simple Secure PIN Strategy — Kids struggle with proper PIN management. Watch this video to learn a simple recipe you can teach your kids to create and remember secure PINs.

- Know If Your Kids Are Gambling With Gaming Currency — Make sure your kid’s online gaming habit isn’t turning into a gambling habit. Here’s how.

- See 75 Random Things Kids Are Saving For — Here are 75 random things kids are currently saving for. See if one inspires a discussion with your child.

- Know When Starbucks Pressure Kicks In With Kids — Here’s when kids start to feel the pressure (or the desire) to head off for Starbucks. How parents can prepare.

Teens

- Teach Teens How To Use Prepaid Cards At The Pump — Prepaid cards are great for teens, but beware of the gas station preauthorization aggravation! Here’s how to pump successfully with prepaid.

- Add An Emergency Fund To Your Kid’s Money Bucket List — Why wait until your kids leave the nest to teach them how to take the first baby step out of financial distress? How to introduce your kids to emergency funds now.

- Take Your Family Swear Jar Online — The family swear jar has moved into the digital age. Here’s how.

- Put Some Pain In Cashless Teen Payment With Instant Notifications — Here’s how to put a little “pain” in your teen’s cashless transactions to foster cash-like spending habits. No pain, no restrain.

- Train Kids To Avoid Overdraft Fees By Dinging Prepaid Declines — Here’s a way to teach your kids how to avoid overdraft fees while using prepaid cards that don’t have them.

- Set Up A Smart Competition To Make Investing Lessons Fun For Kids — Betting on a favorite stock is fun but stupid. Buying an index fund is smart but boring. So how do you make smart investing lessons fun for kids? Here's one way.

- Use A Parent Payment Plan To Hold Teens Accountable For Big Fines — When teens incur bigger fines than their accounts can handle, parents often pick up the tab. Here’s a better solution.

- Use Reimbursements To Teach Teens The Value Of A Dollar — Make teens active participants in the everyday expenses you’re picking up. That way, they’ll know — and appreciate — the real value of a dollar when the day comes for everything to be on their nickel.

- Use Reimbursements To Condition Teens To Maintain A Spending Buffer — Here are two important personal finance lessons your teens can learn using a reimbursement process for everyday purchases.

- Reimburse Your Teen’s Uber And Lyft Rides — Here's one thing I’ll always reimburse for my teens with no questions asked.

- Set The Stage For Socking Away Savings In College — If you set the savings stage early, you might just look forward to texts from your college kids about money, instead of dreading them like most parents.

- Maintain A Net Worth Spreadsheet With Your Teen — A net worth spreadsheet is one of the best techniques I’ve found to help my teens understand the big picture of personal finance. How to lay out a road map to their financial independence one cell at a time.

Did you find a few you’d like to try with your kids in 2017? What else are you resolving to teach your kids about money this year? I’d love to hear.

Happy New Year!

Newer Post

Newer Post

Post a Comment