The How-Not-To Manual on Spoiling Your Kids

We all want to raise kids who are grounded, generous, and smart about money, right?

Yep. Just show us the manual!

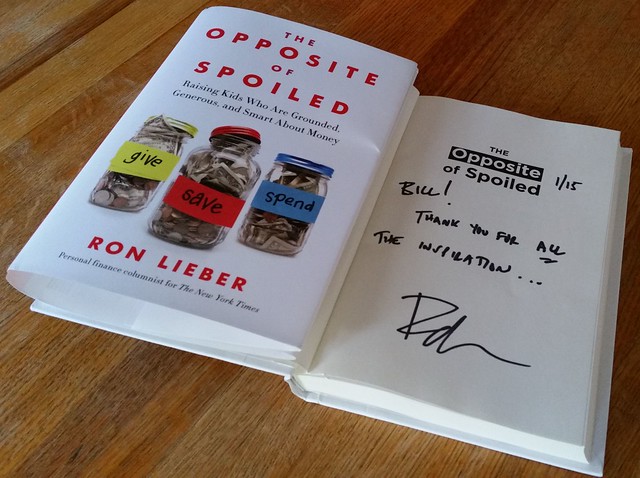

Well, as of last week, you can pick up an excellent one courtesy of Ron Lieber, the personal finance columnist for The New York Times. It’s called The Opposite of Spoiled.

To get a provocative taste of the delicate matters Ron covers in his book, check out this preview article in the Times: Why You Should Tell Your Children How Much You Make. 695 reader comments and counting! I love the bag’o money opener. Clever.

Oh, and if you do get Ron’s book, be sure to check out pages 55 and 60. Our ears are burning!

Is Cash the Best Way to Teach Our Kids About Money?

Numerous studies prove that people are more frugal when paying with cash than when using other forms of payment — especially credit cards and electronic transactions. Why? Cash is tangible. You literally feel pain as you hand over each hard earned bill. That’s why so many parents feel strongly about using bills and coins to teach their kids about money. The less abstract and the more tangible the better, right?

Hmmm...

Then, how are you preparing your kids for the inevitable reality of a cashless society? Don’t we need to teach our kids to manage their money as an abstract number on a computer screen or mobile phone and not just as cash and coins in jar or piggy bank?

Learn more about the why, when, and how of preparing our kids for the digital world of money in my written interview with financial life skills author and speaker, Nancy Phillips.

Does Your 7 Year Old Need a Spa Day? Nope.

Treating young kids to a spa day is a growing trend according to this recent New York Times article: After a Spa Day, Looking Years Younger (O.K., They’re Only 7). Please, no.

I’d say the name of the spa in Long Island captures the concept nicely; it’s called “Seriously Spoiled”. One of the quotes from a mom triggers a serious parental gag reflex too: “I don’t want them to feel that my saying ‘no’ means that I don’t love them.” Yikes.

Thankfully, we’ve yet to see a FamZoo card order in our system emblazoned with the custom label “Spa Day”. May that day never come.

Teen Allowance Blueprint

Family psychologist, John Rosemond, has a thoughtful blueprint for a teen allowance system: it’s a $100 per month, no-advance, non-essentials, non-inclusive-recreation allowance. I like it. Check out the details here.

I love the concert solution at the end. Well played, Dad.

What Does a $250 Econ 101 Textbook Teach Our Kids?

The Wall Street Journal featured an article about the outrageous costs of college textbooks. Ironically, a best-selling economics 101 textbook by Greg Mankiw retails for $360 in new hardcover with the average price of a new edition on Amazon going for over $250.

Why? It’s a completely distorted, subsidized, monopoly dominated market. Coincidentally, I posted a picture on Facebook back in September raising the exact same topic after I noted a ridiculous charge on my son’s College Spending card.

Econ 101 indeed.

Use Nudges to Change Financial Behavior

Simple, consistent nudges — like the text message based ones described in this New York Times article — can be very effective in changing behavior and improving educational outcomes. The same holds for financial behaviors and outcomes. The FamZoo card activity alerts, which always include the current balance amount, serve as a repeated nudge to stay on budget. I’ve watched this simple, almost trivial real-time balance alert feature work wonders with my kids.

Sometimes, all you need is a little timely nudge to stay on track.

Note: You can also set up your own set of custom nudges using the reminder settings on repeating FamZoo checklist items. For example, you might set up a monthly nudge to hold a money meeting with your teen, or a quarterly nudge to check your credit report.

Credit Vs. Prepaid Vs. Bank Debit Cards for Kids

Janet Bodnar, author of the Money Smart Kids column for Kiplinger lays out the three options for letting kids handle plastic: credit cards, bank debit cards, and prepaid cards. Like most youth financial experts and sensible parents, she feels credit cards should be “off limits” until a young adult has a proven track record with accounts and cards that cannot rack up debt. Agreed!

Janet favors a traditional checking account with a bank debit card for teens. I agree this is a solid choice, as long as parents take her wise advice to avoid the bank’s (intentionally) confusing “overdraft protection program” which can swamp your kid’s account with overdraft fees.

Lastly, Janet confesses: “I’ve never been a fan of prepaid cards for children.” She cites three key reasons:

- High fees.

- A core mission of making it simpler for kids to spend money.

- A perception on the part of kids that the card is a “direct line to a parent’s wallet, to be topped off automatically when empty.”

While that may be true of some prepaid card programs, it certainly isn’t the case with FamZoo. I wish I could convince Janet to see a demo of our solution, or at least just take a look at a side-by-side comparison of FamZoo’s card versus a typical teen prepaid card as well as our general list of advantages over credit cards and bank debit cards. Alas, no such luck over the past several years. Perhaps someday...

In the meantime, if Janet, or anyone else, would like to arrange a personal online demo with us to see exactly how FamZoo cards work, just contact us anytime. It’s an open invitation.

The Teen Money Meeting

Have you ever held a money meeting with your teen? Too awkward? Not sure where to start? This Allowance Academy video will help. It’s a great example of a money meeting between a dad and his teen daughter — the mom’s opening cackle notwithstanding!

Now there’s a teen who has her money act together. I’d say the meetings are working. Ready to try one with your teen?

Fostering Teen Entrepreneurs

Sadly, the proportion of young adults owning a business is at its lowest level in 24 years according to the Wall Street Journal. On a positive note, the article features some interesting efforts to encourage teens to learn the basics of entrepreneurship which include:

- As part of its effort to “rebuild the American Dream,” the Milstein Symposium initiative held a recent panel that proposed a national entrepreneurship competition in which teams of kids would pitch their ideas to a panel of judges ala Shark Tank. I’m lukewarm on this one.

- The Network for Teaching Entrepreneurship, a New York City non-profit seeking to inspire youth in low income communities through experiential business education initiatives, is testing a 6 hour online program intended for national distribution that simulates launching a food truck. Check out the 2 minute video demo of the course. Cool. Practical.

- As part of its blended learning transformation, Junior Achievement USA has taken its entrepreneurship program to the Web with components that allow students to raise money online and manage e-commerce transactions. They’re hoping the new approach will counterbalance the steep decline they’ve seen in their traditional program over the past several years. Smart.

Money Supper Club for Millennials

The Society of Grownups is an interesting effort (backed by MassMutual and designed by IDEO) that brings millennials together to learn about and discuss personal finance topics in a neighborhood clubhouse / coffee bar / supper club environment. This Forbes article describes the approach. Kinda funky, kinda cool. Think it will catch on?

A Green Screen Virtual Family Bank

From the way-back machine: an MS-DOS version of a virtual allowance system from 1991. Here’s the description of the program:

From the way-back machine: an MS-DOS version of a virtual allowance system from 1991. Here’s the description of the program:

PC ALLOWANCE v1.0 — Teach kids the basics of banking and handling money and automate their allowance at the same time. Colorful ATM screen, pop-up menus, full mouse support. Multiple accounts, passwords, memos, checks, account statments. Accrue allowance, make deposits and withdrawals, earn interest on savings, borrow and repay loans.

Sound familiar? Anyone have a floppy disk hanging around so I can try it out? :-)

Newer Post

Newer Post

Post a Comment