You’ll find answers to frequently asked questions on two pages:

- General FAQs — applicable to all FamZoo families.

- Prepaid Card FAQs (below) — specific to families using our prepaid cards.

Don’t see an answer to your question?

- Ask the private community, or

- Contact customer support.

Tip: type “famzoo” followed by a search phrase into Google to locate individual entries rapidly, or use our Help Robot.

Tip: Use the Jump To Section link in the footer of the page to navigate quickly between main topics.

- Introduction

- What are FamZoo prepaid cards?

- How do FamZoo cards work?

- How do I get started?

- Why are FamZoo prepaid cards better than cash?

- Why are FamZoo prepaid cards better than credit cards or bank debit cards?

- How can FamZoo cards help my family stay on budget?

- Ordering And Replacing Your FamZoo Cards

- Who can order FamZoo prepaid cards?

- How do I order FamZoo prepaid cards?

- How long will it take for our cards to arrive?

- What if I have address forwarding with the USPS?

- Can I order more FamZoo cards later?

- How do I order a replacement card?

- What if my card is nearing its expiration date?

- Can I order cards as a gift for another family?

- Do your cards have EMV chips?

- Cardholder Verification

- Why do you need our sensitive personal info like SSNs?

- How do you keep our sensitive personal info safe and secure?

- What are your cardholder age and verification requirements?

- I don’t want to enter my family member’s personal info. What are my options?

- What are the steps for manual cardholder verification?

- How do you track purchases and donations for kids under 13?

- What happens when my child transitions to the next cardholder age group?

- Can I add an adult family member in the child role?

- Do FamZoo cards require a credit check or affect credit history?

- Fees, Limits, and Other Legal Stuff

- How much do FamZoo prepaid cards cost?

- Are there any fees for using FamZoo cards?

- Are there any amount or frequency limits on card usage?

- Where can I find your Cardholder Agreement?

- Are the card accounts FDIC insured?

- Activating Your FamZoo Cards

- How do I activate our cards?

- How do I activate a replacement or renewal card?

- Why isn’t the activation link showing up?

- Why doesn’t the Admin number on the activation screen match my card?

- Why isn’t my PIN being recognized for activation?

- Why can’t I see our new cards in the FamZoo app(lication)?

- I’m transitioning from IOU accounts to prepaid cards. What do I do?

- How do I set or update each card’s PIN?

- What is my card’s default PIN value?

- What are the account numbers and PIN for my replacement card?

- What are the account numbers and PIN for my renewal card?

- Moving Money Between Family Members

- How are parent payments for allowance, chores, interest, and one-off credits funded?

- Where do child payments for debits, chore penalties, and bill sharing go?

- Which card is our primary funding card?

- How do I set up automated allowance payments?

- How do I set up payments for chores?

- How do I set up penalties for chores blown off by my child?

- How do I set up parent-paid compound interest to encourage saving?

- How do I make a one-off credit or debit to/from my child?

- Can kids transfer money between their own accounts?

- How do I set up automatic bill sharing with my kids?

- Handling IOUs

- What if there aren’t enough funds to complete a family payment?

- How do I turn off automatic IOU repayment?

- How do I manually repay an IOU?

- How do I cancel or adjust a card IOU?

- What happens when I transfer money between IOU and prepaid card accounts?

- Using Your FamZoo Cards

- Where can I use my card?

- How do I find detailed information about a transaction?

- Do FamZoo cards work with Google Pay, Samsung Pay, and Apple Pay?

- What’s the best way to pay for gas?

- Can I use my card outside the US?

- How do I get cash back from an in-store purchase?

- How do I get cash from an ATM?

- How do I avoid ATM fees?

- How do I set up text or email alerts for activity on our cards?

- How do I silence activity alerts at night?

- How do I lock or unlock a card?

- Can I restrict where a card is used?

- What does it mean when there’s an asterisk next to a card balance?

- Our card has a negative balance! How is that possible?

- What is a partially settled transaction?

- Loading funds onto your FamZoo cards

- How do I load money onto my FamZoo card?

- How do I find the routing and account numbers for direct deposit or ACH transfers?

- I lost my direct deposit form. How can I get a new one?

- Where do I find the two trial deposits during verification?

- When will the transferred funds appear on my card?

- Can I wire funds to a FamZoo card?

- How can I unload funds from my card?

- Reimbursing Expenses for Family Members

- How does reimbursing expenses work in FamZoo?

- How does a family member request a reimbursement?

- How do I approve or deny a reimbursement request?

- Can I reimburse an expense without waiting for a request?

- How do I see the status and history of a reimbursement?

- Requesting Money from Parents

- How do money requests work in FamZoo?

- How does a child make a money request?

- How do I approve or deny a money request?

- How do I see the history of money requests?

- Referral Program

- Can I get paid for referring new families to FamZoo?

- How do I locate and share my special referral link?

- Where and when do I receive my referral bonus?

- How do I check on the status of my referrals?

- Dealing with Problems

- I’m trying to order cards, but online verification is failing. Help!

- My card is being declined when attempting a purchase! Help!

- Where can I find the amount the merchant attempted to authorize?

- I forgot my PIN!

- How do I replace a lost, stolen, compromised, or damaged card?

- How do I verify and change the address associated with my card?

- Am I responsible for unauthorized purchases?

- How do I get MasterCard’s Chargeback purchase protection?

- PayPal complains when I try to link my FamZoo card as a checking account. What can I do?

- How do I close one of the cards in my family?

- Alerts aren’t getting through to my phone. Is there a fix?

- Getting Help

Introduction

What are FamZoo prepaid cards?

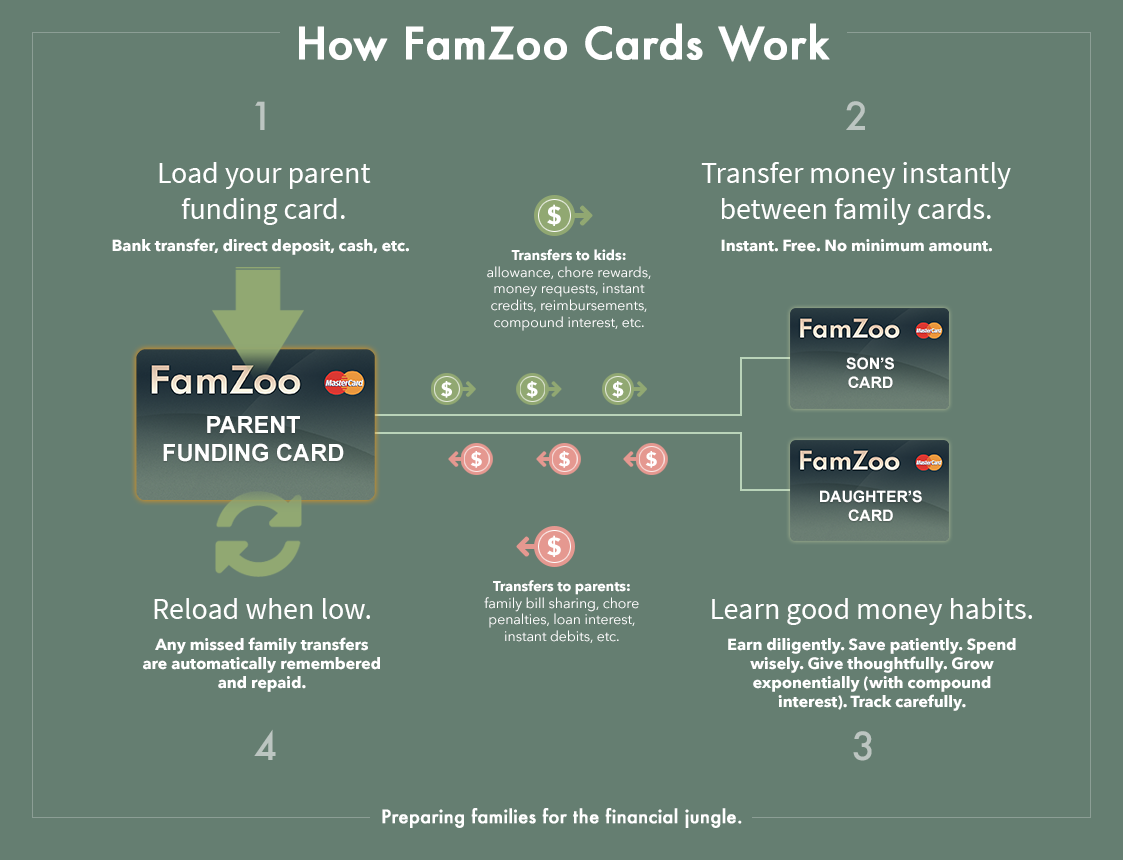

FamZoo prepaid cards are a uniquely affordable, convenient, and educational MasterCard® reloadable card offering designed specifically for families. Linked together and accessed online through FamZoo’s award-winning Virtual Family Bank software, the cards are used collaboratively to share funds between family members and develop financial responsibility.

One of the parent cards — the primary funding card — serves as the automated funding source for allowance, chores, odd jobs, ad-hoc transfers, reimbursements, compound interest, and matching contributions delivered to child cards. Children sign in separately to monitor spending, while parents retain control through a shared dashboard. Additional tools include collaborative budgets, interactive savings planners, “child bill pay”, and automated IOU tracking.

How do FamZoo cards work?

- Order one or more cards for each family member. You can start super simple and just order one card for each family member. Alternatively, you can order multiple cards per family member with each dedicated to a specific purpose — like clothing, lunch money, allowance, charitable giving, saving for a vacation, building an emergency fund, etc. Remember, our MasterCard® prepaid cards are accepted virtually everywhere whether it’s in stores or online. Unlike credit cards or bank debit cards, FamZoo prepaid cards carry no risk of debt, late fees, or overdraft charges. Watch this video to see exactly how ordering FamZoo cards works.

- Load your primary funding card. One card in the family is special. It’s called the primary funding card. From time to time, you load your primary funding card from the “outside world” using your favorite load option. There are lots of options — many of which are free: direct deposit, bank transfer, MasterCard rePower, Reload At the Register, and a variety of popular payment services like PayPal and Apple Pay.

- Distribute money within your family. Once you load up your primary funding card, you can distribute money between your family members instantly and frequently with no fees. Move money whenever you need to by using the FamZoo app or automatically move money at predefined times by creating your own money rules. One of the most popular money rules is a regular allowance paid from the primary funding card to a child card (or a parent card!). Other popular money rules include:

- paying kids for the completion of chores or odd jobs,

- billing your kids for their portion of shared family expenses like smart phone data charges,

- paying kids a parent defined interest rate to encourage good saving habits,

- splitting payments between spending, saving and giving accounts, and

- automatically collecting contributions from family members for a shared family vacation fund.

- Earn. Save. Budget. Spend. Donate. Together. Use our cards and integrated family finance tools to develop smart money habits together.

- Monitor account balances and card activity through our web and mobile app.

- Set and track goals.

- Make budgets and track spending.

- Set aside money for saving and giving through automated deductions.

- Reward your child’s saving with parent paid interest.

- Reward your child’s hard work with parent paid commissions on chores or extra jobs.

For more information, see our Getting Started Guide

How do I get started?

To get your kids and teens started with their new FamZoo cards, please see our step-by-step guide here.

Why are FamZoo prepaid cards better than cash?

Here are just a few of the key reasons FamZoo cards are better than cash when it comes to putting everyday funds in your family’s hands:

- Safer. A FamZoo prepaid card is safer than cash because it can be locked at any time if it’s lost or stolen — or if you just need to put the brakes on some out-of-control spending. The card’s funds are also securely stored in an FDIC insured financial account. And, lastly, Cardholders are protected against certain unauthorized purchases with the MasterCard® Zero Liability policy.

- More convenient, especially online. Unlike cash, FamZoo cards can be used almost anywhere online, and there’s never any fumbling with loose change in stores. Check out our top family convenience features here.

- More mobile. Money can be moved instantly between family members anytime, anywhere via the web or mobile phone. It’s the perfect solution for those little unplanned fiscal emergencies that kids (and even spouses!) invariably encounter.

- More transparent. FamZoo cards automatically record your complete transaction history. Authorized family members can securely browse the history of deposits, transfers, purchases, donations, and withdrawals anytime online. Family members can also receive instant alerts to monitor card activity.

- More educational. Kids learn about online banking, handling the responsibility of a card, and personal finance through our integrated family finance tools. Check out our top financial literacy features here.

- Cleaner. Cash is infested with up to 3,000 types of bacteria. Yuck! FamZoo cards are nice and clean. :-)

Tip: Don’t protect your kids from “magic money”.

Tip: Transition your kid’s allowance to the digital world.

Tip: Stop giving cash to your teens.

Tip: Put some pain in cashless teen payment with instant notifications.

Why are FamZoo prepaid cards better than credit cards or bank debit cards?

Here are just a few of the key reasons FamZoo cards are better than credit cards or bank debit cards when it comes to putting everyday funds in your family’s hands:

- No overdraft fees. Unlike a bank debit card, a FamZoo prepaid card is not tied to a traditional checking account, so there’s never a chance of incurring an overdraft fee.

As an added bonus, you never have to try to understand the intentionally confusing and sneaky terms of an Overdraft Protection program. Tip: “overdraft protection” means “overdraft fees”.

You never have to worry about the auto-billing overdraft loophole that hits the gaming, music, and entertainment subscriptions so popular with kids.

With just one of those overdraft fees, you could have paid for almost an entire year of FamZoo for your whole family (without any of the educational features).

- No risk of debt. Unlike a credit card, you can’t run up a debt on a FamZoo prepaid card. You can only spend as much as has been loaded onto the card ahead of time.

- No risk of late fees. Unlike a credit card, you never make any monthly payments to pay off past purchases, so you can’t rack up any late fees.

- Easier to acquire. Getting a FamZoo card does not require a credit check or credit history. You can order immediately online as long as you meet our minimal verification requirements. Watch our short step-by-step order video.

- More kid friendly. FamZoo cards can be used by or for family members of any age — even kids under 13. Meanwhile, parents maintain visibility and control.

- More educational. Kids learn about online banking, handling the responsibility of a card, and personal finance through our integrated family finance tools. Check out our top financial literacy features here.

Tip: See how free checking isn’t free.

Tip: Watch out for the automatic billing overdraft loophole on debit cards.

Tip: Realize that bank overdraft “protection” really means overdraft penalties.

How can FamZoo cards help my family stay on budget?

FamZoo prepaid cards are the perfect modern digital version of the popular cash-based envelope budgeting system. Instead of labelled envelopes holding cash for each key spending category, use labelled FamZoo cards loaded with funds. It has all of the simplicity and effectiveness of the cash envelope method, but it’s much safer, convenient, and e-commerce friendly.

If you have just one or two problem spending areas you’re trying to get under control, try this simple card-per-category technique.

If you have more than a handful of categories and multiple family members juggling the spending responsibilities, try this more flexible IOU Account technique with just one spending card per family member.

Ordering Your FamZoo Cards

Who can order FamZoo prepaid cards?

FamZoo prepaid cards can be ordered by paying FamZoo subscribers who reside in the United States and have family members who meet our cardholder requirements. Families must remain subscribers in good standing to use their FamZoo cards or to place orders for additional cards.

How do I order FamZoo prepaid cards?

Watch this video for a step-by-step guide to ordering cards for your family. In a nutshell, once you become eligible to order FamZoo prepaid cards, you can follow these steps to place your order:

- Review the cardholder requirements and gather the verification information you’ll need on hand for each cardholder in your family.

- New to FamZoo?

- Visit FamZoo.com.

- Select the Order Cards button and follow the screens to register your family, pick a subscription plan, and order your cards.

- Already a FamZoo member?

- Sign in to your FamZoo account as a parent.

- Select the Billing ⟩ Payments menu item.

- Select Order Cards in the left hand sidebar, and you’ll be guided through the rest of the steps.

Once you receive your cards in the mail, the activation process will step you through setting up your family’s prepaid card accounts and any optional settings like allowance schedules, chore lists, interest payments, etc. The initial load amount that you selected while ordering your cards will appear on the primary funding card as soon as it is activated.

How long will it take our cards to arrive?

After successfully completing an order online, it will take 7 to 10 business days (which excludes weekends and holidays) for your cards to arrive in the mail. You’ll receive an order confirmation email right away.

Each card arrives separately in its own nondescript envelope from our card processing partner TransCard. Be on the lookout for envelopes that look like this:

It’s not unusual for cards to arrive on different days. Please wait until all the cards in your order arrive before activating online.

Also, note that cards are sent to shipping as soon as they are verified. So, if you verify some cards and pause or cancel your order, those verified cards will still arrive. If you receive cards from a cancelled order, check with us and we’ll let you know which cards you can safely discard.

Tip: Use this printable card template if you need to present FamZoo as a gift before the real cards arrive.

What if I have address forwarding with the USPS?

If you have a forwarding notice on file with the USPS, we can’t guarantee the “ADDRESS SERVICE REQUESTED” directive stamped on our shipping envelopes will be honored consistently by the USPS. We’ve seen forwarded cards take as long as a month to arrive.

Can I order more cards later?

Yes, you can order additional cards for your family members after you’ve placed your initial order. You’ll also need to order a separate new card if your child transitions into a new cardholder age group. (Note: if you need to replace an existing lost, stolen, compromised, or damaged card, see here instead). To order additional cards, follow these steps:

- Sign into your FamZoo account as a parent.

- If you’re on a mobile device, switch into the Desktop UI by following the instructions here.

- Select the Bank ⟩ Accounts menu item.

- Select Order More Cards in the left hand sidebar, and you’ll be guided through the rest of the steps.

Tip: See the article here if you are adding multiple cards for a family member to allocate funds between separate purpose-driven accounts like spending, saving, and giving.

How do I order a replacement card?

If you think a card in your family has been lost or stolen, be sure to see the comments here before requesting a replacement.

If your card is nearing its expiration date, a new card will be automatically sent to you in advance. See here for details. There should be no need to order a replacement.

Before ordering a replacement, please note these two important items:

- Replacement cards are automatically shipped to the address on file for the card being replaced. You’ll find the current address for each card on the Card Information screen. You can also contact us to find out the current address on file. If the address has changed, follow these instructions to update it first.

- The original card account will be blocked (unable to receive or transmit funds or make purchases) from the time you initiate the replacement with us until the replacement card arrives in the mail (7 to 10 business days) and we activate it for you. So, you’ll need to plan accordingly — especially if you are replacing your primary funding card.

If the card is damaged, but still partially functional (via digital wallet tap-to-pay, magnetic stripe read, or online entry) and you need uninterrupted service, consider ordering an additional card instead of a replacement. When the additional card arrives, contact us. We can transfer the balance and settings to the new card and retire the old card for you.

You can order a replacement for a lost, stolen, compromised, or damaged card as follows:

- Sign into the FamZoo application as the registering parent.

- Note the last four digits of the card number for the lost, stolen, compromised, or damaged card. You’ll see the last four digits listed next to its account name in the Overview or Accounts page.

- Click on the Contact Us link at the top of the page.

- Fill in the Message field with the request: “Please replace the card ending in NNNN.” Substitute NNNN with the last four digits of the card number for the card being replaced. Note: for your security, please do not send the full card number in your message — just the last four digits.

- Indicate whether the card was lost, stolen, compromised, or damaged.

If you believe the card is compromised, list the dates, descriptions, and amounts of the unrecognized transactions.

- Also include the mailing address for the card so we can be sure it matches and is up to date.

- Click Send

- We will send you a response by email confirming your request.

- Your replacement card should arrive within 7 to 10 business days of our confirmation.

When your replacement card arrives in the mail, see here. We have to activate it manually for you.

Tip: Ding your kids for replacements when they become too cavalier about caring for cards.

What if my card is nearing its expiration date?

Our cards expire after 3 years. You will automatically receive a renewal card in the mail a few months before the expiration date. The renewal card will be delivered to the address on file for the expiring card. If you need to update your address, see here.

When the renewal for your expiring card arrives in the mail, see the activation instructions here.

Can I order cards as a gift for another family?

Federal law requires card issuers to collect sensitive personal info about the cardholder before opening an account, so you can’t just order cards for your friends or their kids directly. With FamZoo, you can do the next best thing though: you can pay the monthly fees for your friend in advance with a gift subscription. When your friend redeems the gift code during registration, she’ll be credited for the free months that you purchased and can place her card order (as long as the family members are eligible).

Click here to order a gift subscription.

For some examples of how to present your gift subscription along with printable gift certificates, see here.

If you’d like to bulk order gift subscriptions at a discount for a group of friends, colleagues, or clients, please contact us. We even offer a co-branded version of the FamZoo app(lication) for your company or organization.

Do your cards have EMV chips?

Yes. We launched EMV chip cards for new registering families on October 29, 2020. All of our existing families with magnetic stripe cards will be automatically upgraded to the new EMV chip cards at no additional charge.

Cardholder Verification

Why do you need our sensitive personal info like SSNs?

We are required by law to verify the identity of our prepaid cardholders. To do so, we gather the required personally identifiable information (including each legal cardholder’s social security number) during the card ordering process and send it securely to our card processing partner, TransCard.

Here’s how we keep your sensitive personal info safe.

Don’t want to supply sensitive personal info for your family member? See here.

How do you keep our sensitive personal info safe and secure?

We do not store your most sensitive verification or account information on FamZoo’s servers. For example, your social security numbers and card account numbers are never stored in a FamZoo database. Each time a cardholder is verified during the card ordering process, we securely transmit the verification info to our card processing partner, TransCard, and immediately discard the most sensitive personal data. Furthermore, we never store your actual card account numbers, TransCard does.

So what about the safety and security of your data at TransCard? They are required to meet financial industry standards. Consequently, TransCard is:

- A direct processor with MasterCard.

- MasterCard Network certified.

- PCI DSS compliant (See Payment Card Industry Data Security Standard).

- SSAE 16 compliant (See Statement on Standards for Attestation Engagements 16).

Lastly, we store your passwords in encrypted format, so don’t ask us to tell you your password — we don’t know it! If you do forget your password, see here.

Obviously, we take the security of our own FamZoo servers very seriously, too. But if some nefarious hackers somehow break in, they won’t find any of your social security numbers, card account numbers, or passwords. That’s a relief.

What are your cardholder age and verification requirements?

You must supply the following personally identifiable information for each applying cardholder in the family:

- Legal name

- Date of birth

- Social Security Number

- U.S. physical residential address

- Email address

- Telephone number

Cardholders fall into one of the following categories:

- Adult parent: must pass our online adult verification process. There must be at least one adult parent cardholder in each family. If an adult parent cardholder in your family is unable to pass the online verification service while attempting to order cards, please see here.

- Adult Child (age 18 or older): must pass our online young adult verification process while ordering cards or a subsequent manual verification process.

- Teen (age 13 to 17): must pass our online teen verification process while ordering cards.

- Young Child (age 12 or younger): the parent is the legal cardholder in this case and the child’s name can be included in the custom label line just beneath the parent’s name. Read here for more information on how that works.

Here’s how we keep your sensitive personal info safe.

I don’t want to enter my family member’s personal info. What are my options?

If you do not want to supply the personal info required to make your family member the legal cardholder, you can order an “on-behalf-of” card for your family member instead. That way, you’ll be the legal cardholder — just as in the case of pre-teen cards.

To order an “on-behalf-of” card for your family member, leave the birth date setting unspecified when adding your family member. (Contact us if you need help removing your family member’s birth date or adjusting an order in progress.)

Then, when adding a card for your family member, you’ll be given the option of selecting a parent as the cardholder instead of the family member. Choose a parent as the cardholder and include the family member’s name in the custom label. The label will be printed just beneath the parent’s first and last name on the face of the card.

What are the steps for manual cardholder verification?

If we are unable to fully verify cardholder info for a family member through our online order process, you’ll be asked to submit the following documentation for that family member as part of our card processor’s manual verification process:

- Legal name

- Date of birth

- U.S. physical residential address

- Social Security Number (Required for all FamZoo cardholders)

Note: a picture or scan of the physical social security card may be required for some applicants.

- Two forms of identification, at least one of which must be a primary form:

Primary Identification (At least one) Secondary Identification Current passport. School or work ID with cardholder photograph. Current state-issued driver’s license or learner’s permit. Social Security Card. Current United States military identification. Utility bill, lease agreement or current paystub printed with an address that matches the primary identification address. United States government issued document evidencing nationality or residence and bearing cardholder photograph. ATM card or credit card with name and signature matching primary identification. Mexican Matricula Consular card or US recognized tribal identification card. Bank statements issued within last 6 months, with an address that can be verified.

Note: otherwise qualifying identification will not be accepted if:

- The identification is expired

- The identification is damaged, illegible, or shows other signs of tampering or alteration

- The driver’s license is clipped, unless accompanied by valid renewal papers

- The information on any identification is inconsistent with information provided on any other identification

- The address provided is a post office box, general delivery address, or other non-physical residential address

To initiate the manual verification process, please:

- Gather the required documentation from the list above.

- Contact us so we can provide you with the instructions for securely uploading the documentation to our card processing partner via encrypted email. Do not send any of your sensitive info or documentation to FamZoo.

How do you track purchases and donations for kids under 13?

For kids under 13, we issue what we call “on-behalf-of” cards. In this case, the parent is the legal cardholder and the card is used to track purchases made on a pre-teen’s behalf. Pre-teen children will see their on-behalf-of cards and transactions when signed into the FamZoo app(lication). In some rare cases, the parent may have to accompany the child for in-store payment transactions in which the merchant might verify that the legal cardholder is present. Of course, this is irrelevant to online payments which are cardholder-not-present scenarios.

Note that each card has a customizable emboss line that appears just beneath the legal cardholder name. Typically, parents put the name of the child or something like “Johnny’s Spending” or “Suzy’s Spending” on that line.

Hesitant? Nearly half of the kids using FamZoo cards are under 13. Parents and kids alike have been very happy with the “on-behalf-of” arrangement.

You’ll find more information on why FamZoo prepaid cards are great for kids under 13 here.

What happens when my child transitions to the next cardholder age group?

Once your child exceeds the age limit of a cardholder age group, you’ll need to order a new card in the next age group if you want to change the cardholder name or the custom label printed beneath it. (Otherwise, if you’re happy with the current cardholder name and label, there’s no need to do anything.)

To transition to a new card, follow the same steps you would to add a new card to your family.

When the new card arrives, contact us and we will perform these steps quickly for you:

- Update any allowances, chore rewards or penalties, auto-debits, etc. that referenced the old card to reference the new card.

- Transfer any funds remaining on the old card to the new card.

- Close the old card.

- Hide the old card account if desired.

Can I add an adult family member in the child role?

Yes, adults can be added as child family members to restrict their access to just viewing and using their own cards.

This is a very common arrangement in families caring for elderly parents, adult children with disabilities, or family members struggling with addictive behaviors.

It’s also a common way to allow divorced partners, grandparents, or other relatives to contribute funds without granting access to the funds on other cards in the family. In the child role, they can load their cards with money independently of the primary funding card using any of our load options. Then, they can issue money transfer requests to move funds to another family member subject to the approval of a family member in the parent role.

Please note that the registering parent is responsible for the oversight of all cards in the family and is liable and wholly responsible for all card transactions.

Tip: Preserve financial dignity for your elderly loved ones.

Tip: How to deliver allowance and chore payments from multiple parents.

Do FamZoo cards require a credit check or affect credit history?

Nope and nope.

No credit check (neither hard nor soft inquiry) is performed during FamZoo cardholder verification, and using a FamZoo card has no impact on your credit history. By using a FamZoo card, you can’t do anything to your credit score: you can’t damage it, you can’t improve it, you can’t establish it. That’s because FamZoo cards simply aren’t a credit instrument. Attempting to spend more than the amount of money currently loaded on the card will just result in the purchase being declined.

If you are seeking to build a credit history for your child, one technique you might consider is having your child use a credit card for a very narrow category of predictable expenses — like a fixed recurring bill. Then use prepaid cards for remaining expenses as a way to stay on budget and out of debt. If your child does use a credit card, be sure to pay the balance off in full every month!

Tip: Use a hybrid card strategy to help teens build credit and stay on budget.

Tip: Build your teen’s credit score with a secured card.

Pricing, Fees, Limits, and Other Legal Stuff

How much do FamZoo prepaid cards cost?

A paid FamZoo subscription entitles you to use all of the active prepaid cards in your FamZoo family for as long as your subscription remains active. Adding family members and adding cards does not impact your subscription fee.

When you register directly on FamZoo.com, we offer the following standard pricing and billing options for your family’s FamZoo subscription:

- Monthly — your family pays a $5.99 recurring fee that is automatically billed each month. You can cancel anytime to terminate the monthly billings.

- Pay-in-advance — your family makes a one-time payment for a block of 12 months up front at a discount:

YOU PAY WHICH EQUALS WHY PRE-PAY? $59.90

for 12 months$4.99

per monthYou save $11.98 Unlike the monthly plan, the pay-in-advance plan does not automatically renew — we send you an email just before your term is up so you can select a new payment plan when you manually renew.

All subscription pricing above covers your whole family and is the same whether your family uses IOU accounts, prepaid card accounts, or a mixture of the two.

If you order our prepaid cards, you may incur additional fees in certain cases such as ordering more than 4 cards, expediting card delivery, or ordering more than 3 replacement cards. For our comprehensive CFPB prepaid card fee disclosure statements, see here.

Note: all FamZoo subscription fees, whether monthly or pay-in-advance, are billed to your credit/debit card or PayPal account. Subscription fees are not assessed to your FamZoo cards unless you explicitly update your billing information to use your FamZoo card after it has been activated.

There are amount and frequency limits for loading cards, transferring money between cards, withdrawing cash from cards, and making purchases. See here for amount and frequency limit details.

Are there any fees for using FamZoo cards?

All of our card fees are listed here.

Are there any amount or frequency limits on card usage?

FamZoo cards are subject to certain amount and frequency limits when it comes to putting money on the cards, transferring money between cards, withdrawing cash from the cards, and making purchases. The limits apply to each card independently and are as follows:

| Activity | Limits |

|---|---|

| Card Load Amount | $2,500 per load |

| Card to Card Transfer Amount | $2,500 per transfer |

| Number of Loads and Transfers | 99 per day |

| Total Card Balance | $5,000 |

| Maximum Purchase/Donation Amount | $5,000 per single POS transaction $5,000 per day |

| Maximum ATM Withdrawal (Domestic and International) |

$510 per day |

| Maximum Cash Withdrawal from Issuing Bank (Parent Card) |

Full Balance on Card |

| Maximum Cash Withdrawal from Issuing Bank (Child Card) |

$500 per single transaction $500 per day |

IMPORTANT: Cash reload providers like Green Dot impose limits on reloading prepaid cards that are typically more restrictive than the FamZoo card limits above. These limits include:

- Per Transaction Limits: varies by retailer, but often $500. Certain Walmart locations may allow up to $1,000.

- Daily Transaction Limit: varies by retailer, but often 3 reloads.

- Maximum Daily Reload: varies by retailer, but often $3,000.

- Rolling 30 Day Reload: varies by retailer, but often $5,000.

Where can I find your Cardholder Agreement?

You can download and read a PDF document containing the Cardholder Agreement for FamZoo prepaid cards issued by SouthState Bank here: http://famzoo.com/legal/CardholderAgreement.pdf.

You can download and read a PDF document containing the SouthState Bank Privacy Policy here: http://famzoo.com/legal/PrivacyPolicy.pdf.

Are the card accounts FDIC insured?

Yes, the funds in the card accounts are insured to the maximum limit provided by the FDIC as long as we are able to fully verify the cardholder’s identity.

Activating Your FamZoo Cards

How do I activate our cards?

Please follow the instructions for activating cards here.

If one or more of your cards requires manual verification, please see the additional instructions here.

For each card you receive, set the PIN, and have the appropriate cardholder sign the back.

Why isn’t the activation link showing up?

If you’ve received your cards and the Activate Cards link is not visible when you sign into FamZoo as the parent, it’s typically due to an incomplete card order.

Since we ship each card immediately upon cardholder verification (so we never have to store your most sensitive personal info on FamZoo servers), cards can arrive even though you have not completed final checkout for your order. The activation link will only appear when final checkout has been completed.

To see your order status, click on the Orders link under the Store tab in the Desktop UI. If you have a pending order, you’ll be able to resume it there. Complete your order through checkout, and the activation link will become visible.

If that doesn’t do the trick, contact us, and we’ll help you complete your order.

Why doesn’t the Admin number on the activation screen match my card?

If you’ve received your cards and the Admin number displayed on the initial activation screen does not match the Admin number printed on the back of your primary funding card, you’ve probably received a card from a cancelled order.

Since we ship each card immediately upon cardholder verification (so we never have to store your most sensitive personal info on FamZoo servers), cards can arrive from cancelled orders that never reach final checkout.

Please contact us, and we’ll help you identify the right cards for your completed order as well as close out cards from old cancelled orders.

Why isn’t my PIN being recognized for activation?

This typically happens when you’ve contacted our card processor’s phone support via the 1-800 number prior to activating the cards online. The phone support process will often force you to select a new PIN for your card if it hasn’t been updated from its default value. If this is the case, enter your new updated PIN in the Card Activation PIN field instead of the card’s default PIN.

Why can’t I see our new cards in the FamZoo app(lication)?

If you aren’t seeing some or all of your FamZoo cards when you sign into FamZoo, it may be due to one of the following reasons:

- You haven’t activated your new cards online yet. Activate your new cards online by following the instructions here. Cards will only appear within the FamZoo app(lication) after they are successfully activated online at FamZoo.com.

- You activated your new cards over the phone. You can’t fully activate FamZoo cards by telephone. So if you have already called the 1-800 number to activate your cards, you will still need to activate them online. Note that in the process of activating your cards over the phone, you were probably required to update your PIN from the default setting. If so, be sure to enter your updated PIN when activating online (even if we ask for the default one).

- You ordered a new or replacement card over the phone. All FamZoo cards must be ordered online from FamZoo.com. If you ordered a new or replacement card via the 1-800 number, please contact us so we can perform the extra step required to make it visible within FamZoo.

- The card account has been hidden. It’s possible a parent in your family hid the card account and you just need to unhide it.

How do I activate a replacement or renewal card?

When you receive a replacement for a lost, stolen, compromised, or damaged card, please follow the instructions here.

When you receive a new card for a card that is expiring soon, please follow the instructions here.

I’m transitioning from IOU accounts to prepaid cards. What do I do?

If your family has already been using FamZoo’s IOU accounts, and you are transitioning some or all of your accounts to prepaid card accounts, you’ll want to edit your existing automatic payment definitions (allowances, splits, automatic debits, chore rewards/penalties, etc.) to deliver all or some of those payments to your new prepaid card accounts. You’ll find a blog post that walks through the transitioning steps here.

How do I set or update each card’s PIN?

To keep your cards secure, set their PINs as soon as you receive and activate them online. You can change a card’s PIN any time after it has been activated.

If this is your first time setting a card’s PIN, its initial value will be the default PIN value (zero followed by the three digit security code). Note that each card has its own PIN and default value.

Security Note: PIN changes are managed directly by our card processor, Transcard, either via a secure web form or over the phone. That way, none of the sensitive information entered during a PIN change is ever stored in FamZoo servers. For more details on how we keep your most sensitive personal info secure, see here.

To change your card’s PIN, choose one of the following options provided by our card processor, Transcard:

- By phone: call 1-800-416-6373. Follow the automated voice prompts, or press 0 to speak with a representative.

- Online: visit https://9raja9eg.transcard.com/ in a web browser. Fill out the secure online PIN change form.

Note: attempts to update the PIN will fail when the card is locked.

If you have trouble changing your PIN, need your PIN reset to its default value, or need a PIN security block lifted, contact us.

Tip: Teach kids a simple secure PIN strategy. (Video)

What is my card’s default PIN value?

Your card comes with a default PIN value of 0 followed by the three digit card security code which is located on the back of your card just to the right of the signature stripe.

If your card ever falls into the wrong hands, someone could figure out the default PIN. So you should change the default PIN to a more secure value as soon as you activate your card.

What are the account numbers and PIN for my replacement card?

Note: your replacement card will have:

- A new default PIN setting instead of the PIN from the old card, so you’ll need to update the PIN right after we activate it.

- A new card number and expiration date listed on the front of the card, so you’ll need to update the payment info you’ve saved with any merchant.

- The same routing and account numbers as the replaced card, so any card load options that depend on those numbers should continue to work properly.

What are the account numbers and PIN for my renewal card?

Your renewal card will have:

- A new expiration date on the front of the card.

- A new security code on the back of the card.

- The same PIN setting as the expiring card.

If you never updated the expiring card’s PIN setting, the renewal card’s initial PIN will be the default PIN setting of the expiring card. Contact us if you need help updating your renewal card’s PIN.

- The same card number on the front of the card.

- The same admin number on the back of the card in the bottom right corner.

- The same routing and account numbers as the expired card, so any card load options that depend on those numbers should continue to work properly.

Important: You’ll need to update the card expiration date and security code you’ve saved with any merchant.

Note: In some cases — like if you inadvertently use the original expiring card after the renewal card has been activated — the security counter setting in the chip of the renewal card can fall into an invalid state. If it does, you’ll experience declines when using the renewal card at point of sale devices. If this happens, please call the 800 number on the back of the card (or contact us) and request a reset of the EMV chip counter.

Moving Money Between Family members

How are parent payments for allowance, chores, interest, and one-off credits funded?

As a parent, you can direct FamZoo to automatically deliver payments to your child for allowance, chores, or parent-defined compound interest. What’s the source of funds for those parent payments? The money comes from the primary funding card. Behind the scenes, whenever FamZoo processes an automated parent payment or a manual one-off credit to a child’s card, it transfers the amount from the primary funding card to the child’s card.

Where do child payments for debits, chore penalties, and bill sharing go?

As a parent, you can direct FamZoo to automatically charge your children for missed chores or their portion of a shared family expense. Where does the child’s payment go? Whenever FamZoo processes an automated child payment or a manual one-off debit from a child’s card, it transfers the amount from the child’s card to the primary funding card.

Which card is our primary funding card?

Your primary funding card is the source of funds for parent payments and the recipient of funds for child payments. It’s the very first parent card you created in your original card order. To see which of your cards is the primary funding card, you can:

- Sign in to your FamZoo account as a parent.

- Visit the Accounts page.

- Locate the parent card that does not have plus or minus icons in front of it.

How do I set up automated allowance payments?

You can set up automated allowance payments to your children when you activate their cards. Just look for the Set Up Allowances and Splits screen during the activation steps.

If you have already activated your cards, follow these steps to add or change an allowance:

- Sign into FamZoo as a parent.

- Click on the Bank tab.

- Click on the Allowances/Splits link.

- To create a new allowance, click on the Create Allowance link.

- To change an existing allowance, hover your mouse over the desired allowance, and click on the pencil icon. Alternatively, you can click or tap on the Edit action link in the left-hand sidebar and pick the desired allowance from the drop-down list.

- Watch this video for more detailed info.

How do I set up payments for chores?

You can set up chore charts in FamZoo that automatically make payments to your child’s card (or cards) whenever a chore is completed. Follow the steps here and be sure to pick the desired card accounts in step 10.

How do I set up penalties for chores blown off by my child?

Follow the same instructions for setting up chore payments, but in step 10, indicate that you’d like to debit your child’s card account rather than credit it. The debit can happen either when the chore is checked off explicitly or when the chore expires. See an example of the former here.

How do I set up parent-paid compound interest to encourage saving?

You can encourage your child to save by paying compound interest on the current card balance at regular intervals. Remember, the interest payment is coming from your primary funding card, not from FamZoo. Follow these steps to set up automatic interest payments for your child’s card:

- Edit your child’s account.

- Look for the Interest section, and fill in the interest rate, the compounding frequency, and the desired start date.

- To see what kind of damage you might be in for, select Calculate Interest and play around with the settings to project what future interest payments might look like.

If you’re rewarding your child with an aggressive Bank of Mom/Dad compound interest rate, you may want to put a cap on it before you land yourself in the poor house! Watch this video for more info.

Tip: Motivate your kid to save in a way that traditional savings accounts can’t.

Tip: Offer parent-paid interest for spending, giving, and even (not) spending.

Tip: Set the stage for socking away savings in college.

Tip: Run your own teen card program that rewards less spending.

Tip: Play the Sweep-To-Savings game with your teen.

Tip: Offer kids a savings match with strings attached.

How do I make a one-off credit or debit to/from my child?

Click on the credit button next to your child’s card account to move money from your primary funding card to your child’s card.

Click on the debit button next to your child’s card account to move money from your child’s card to your primary funding card.

Can kids transfer money between their own accounts?

Yes, but only with parent approval. Kids can click on the Request Transfer action link (Desktop UI) or menu item (Mobile UI).

If you’d like your kids to be able to request transfers between their accounts and the accounts of other family members, edit your family settings and set the Allow Money Requests Between Members option to YES.

If your kids need to make transfers without parent intervention, you an use a trick with checklists to allow your kids to make very specific money movements. Read about the trick here.

How do I set up automatic bill sharing with my kids?

To automatically charge your child for a portion of a recurring family expense (like a cell phone plan), follow these steps:

- Sign into FamZoo as a parent.

- Click on the Bank tab.

- Click on the Automatic Debits link.

- Click on the Create link and choose your child from the drop down list.

- Fill in the fields and be sure to select your child’s card account in the drop down list.

- Click the Create Automatic Debit button.

Handling IOUs

What if there aren’t enough funds to complete a family payment?

Suppose it’s time to make an allowance, interest or other payment to your child and you don’t have enough funds on your primary funding card to cover the amount? No worries! FamZoo will automatically track the amount owed as an IOU owed to your child’s card. Later, when you reload your card, FamZoo will automatically pay off any outstanding IOUs you may have.

This works in the reverse direction for child payments. If a child’s card balance can’t cover a penalty, shared expense or other payment to the parent, the amount owed will be tracked as an IOU for the card. Any subsequent parent payments will go toward reducing the outstanding IOU amount before moving any additional money to the card.

For more information on card IOUs, see here.

How do I turn off automatic IOU repayment?

To turn off the automatic repayment of IOUs to a family member’s card account (or to turn it back on), follow the instructions here for editing the account, and update the Repay IOUs Automatically setting.

How do I manually repay an IOU?

To manually repay all or part of an IOU amount that is owed to a family member’s card:

- Sign into FamZoo as the parent.

- If you’re on a mobile device, switch into the Desktop UI by following the instructions here.

- Select the Bank ⟩ Accounts menu item.

- In the main section of the Accounts screen, select the name of the prepaid card account for which you wish to repay the IOU.

- Select Repay IOU in the left-hand sidebar of the account’s Transactions screen.

- Complete the Repay IOU form with an amount up to the amount of the IOU but no greater than the current balance on your primary funding card.

How do I cancel or adjust a card IOU?

If there is an automatic IOU owed to (or by) a card that no longer needs repayment, you can cancel the IOU as follows:

- Sign into FamZoo as the parent.

- If you’re on a mobile device, switch into the Desktop UI by following the instructions here.

- Select the Bank ⟩ Accounts menu item.

- Locate the card account with the IOU in the Accounts screen.

- If the IOU amount shown beneath the card balance is positive, select the Debit (minus) icon to the left of the account name.

- If the IOU amount shown beneath the card balance is negative, select the Credit (plus) icon to the left of the account name.

- Complete the form with an amount equal to the card’s outstanding IOU balance.

This will reset the IOU balance for the card to zero, which means it is not owed money by (nor owes money to) the primary funding card.

You can also use the Credit and Debit icons to adjust the card IOU up or down by the desired amount.

What happens when I transfer money between IOU and prepaid card accounts?

When you transfer money from a prepaid card account to an IOU account, you’re moving money from an account that holds actual dollars to one that doesn’t. You’re effectively converting dollars to IOUs. Those dollars have to go somewhere, so they’re returned to your family’s primary funding card. After the transfer, you’ll see a debit to the source prepaid card account, a credit to the destination IOU account, and a credit to the primary funding card.

Conversely, when you transfer money in the other direction — from an IOU account to a prepaid card account, you’re converting an IOU amount to cash. Since cash can’t be materialized out of thin air, the funds are pulled from your family’s primary funding card behind the scenes. After the transfer, you’ll see a debit to the source IOU account, a credit to the destination prepaid card account, and a debit to the primary funding card.

Using Your FamZoo Cards

Where can I use my card?

You can use your FamZoo card anywhere Debit MasterCard® is accepted. That’s gazillions of places worldwide in stores as well as online. Seriously, it’s about as close to ubiquitous as you can get from a merchant acceptance standpoint.

How do I find detailed information about a transaction?

You can detailed information about a transaction as follows.

- Click or tap on the balance amount of the desired card to get to its Transactions listing.

- Click or tap on the transaction status lozenge displayed just beneath the transaction date.

Do FamZoo cards work with Google Pay, Samsung Pay, and Apple Pay?

The answers are: yes, yes, and yes.

NOTE: Apple restricts Apple Pay for children under 13, and Google restricts Google Pay for children under 16.

What’s the best way to pay for gas?

ALWAYS take the card into the gas station attendant first and tell him/her to charge the card beforehand for the exact amount you want to pump — just like you would do with cash. Otherwise, the card reader device at the pump will try to preauthorize a large sum up front which may exceed your current balance. Even more frustrating, if the card is declined as a result, there may be an authorization hold on your money for up to 30 days! That’s totally outrageous as far as we are concerned, but unfortunately there is nothing FamZoo can do about such holds. So, avoid all that potential aggravation and teach your teens to take the card in to the attendant and say: “Please charge my card exactly $X dollars for gas on pump number Y.”

And, if you happen to pump less than the authorized amount, be sure to print a receipt (if possible), return to the attendant, and confirm that the purchase has been adjusted to the lower amount.

Tip: Teach teens how to use prepaid cards at the pump.

Can I use my card outside the US?

You can use your FamZoo card worldwide for temporary travel anywhere MasterCard is accepted. However, please note the following critical items:

- Foreign Transaction Fees — None. See here.

- Travel Note — Transaction activity in a foreign country can trigger our card processor’s automatic fraud detection system. To minimize that possibility, please contact us and communicate the last 4 digits of the card(s), the dates of the trip, and the destination countries. We’ll make sure your travel information is placed on file with our card processor.

- Test Your Chip — we recommend verifying your EMV chip works by making a local purchase at least 10 business days before travelling abroad.

- Update and Test Your PIN — Make sure you have updated the default PIN to a secure value. To test that you know your current PIN, call the 1-800 number on the back of the card and make sure you can pass the automated PIN challenge.

- Credit vs Debit — If you have trouble completing a transaction at a foreign point of sale device, ask the clerk to explicitly run the card as a PIN based debit transaction. Sometimes that will address the problem.

- Digital Wallet — If you’re still having trouble completing a transaction at a foreign point of sale device, try adding your card to a digital wallet (Apple Pay, Samsung Pay, Google Pay) and using your phone to complete the purchase.

Tip: Travel considerations for kids with cards.

How do I get cash back from an in-store purchase?

If you’d like to get cash from your card while you’re making a purchase at a store, ask the merchant if they offer a cash back option. If so, then:

- choose the DEBIT option on the point of sale device when paying,

- enter your PIN, and

- the merchant will give you the cash amount you choose.

How do I get cash from an ATM?

Locate an ATM machine, enter your PIN, select CHECKING, and complete the withdrawal transaction.

FamZoo does not charge any ATM fees, but you are likely to be charged a fee by the ATM operator.

Important: You cannot deposit cash onto your card from an ATM. To load your card with cash, see our cash load options.

How do I avoid ATM fees?

FamZoo does not charge any ATM fees, but you are likely to be charged a fee by the ATM operator. Consider getting cash back from an in-store purchase instead.

Note: as of our switch to SouthState Bank on October 29, 2019, our cards no longer belong to a free ATM network.

Important: You cannot deposit cash onto your card from an ATM. To load your card with cash, see our cash load options.

How do I set up text or email alerts for activity on our cards?

Family members can receive text or email alerts whenever there is activity (like a purchase, an allowance payment, a load, etc.) on a card. Your kids can be alerted to what is happening on their cards, while you as a parent can be alerted to activity on both your own cards and your kids’ cards.

To set up card activity alerts:

- Sign into FamZoo as the parent.

- If you’re on a mobile device, switch into the Desktop UI by following the instructions here.

- Select the Bank ⟩ Accounts menu item.

- Hover your mouse over the prepaid card account for which you’d like to receive alerts and select the gear icon. Alternatively, select Account Settings in the left-hand sidebar, and choose the desired prepaid card account from the drop-down list.

- Scroll down to the Card Activity Alerts section of the Edit Account form, and select Add An Alert to identify the recipient and the alert type — either text message or email. You can add multiple alerts with different recipients. Submit the form when finished.

To review or update the phone number or email address on file for a family member, see here.

Tip: 5 reasons to turn on card activity alerts for your kids.

Tip: Use activity alerts to teach kids financial literacy in the moment.

How do I silence activity alerts at night?

It isn’t unusual for FamZoo card activity to happen in the middle of the night. When it’s 1am, you probably don’t want to be jolted awake by allowance delivery messages from FamZoo, but you definitely do want to receive urgent text messages from your teens. The best way to silence incoming FamZoo (and other non-critical) messages during quiet periods is to use the Do Not Disturb settings supported by most recent model smart phones. Adjust your settings to allow only messages from favorite contacts or specific group members during quiet time. You’ll find Do Not Disturb help for iPhones here and Android here.

How do I lock or unlock a card?

Locking a card temporarily prevents the card from being accepted for purchases or participating in card-to-card transfers until it is subsequently unlocked. Direct deposits and bank transfers are unaffected by locking.

To lock (or unlock) a card:

- Sign in as the parent.

- Click or tap on the balance amount of the desired card to get to its Transactions listing.

- If you are in the Desktop UI, click on the (Un)Lock Card link in the left hand sidebar.

- If you are in the Mobile UI, select the Lock Card menu item.

- You will be asked to confirm the operation.

Can I restrict where a card is used?

We do not have the ability to restrict where the card is used. We lean toward a “trust-but-verify” stance on the topic.

We encourage parents to turn on activity alerts for each card so that both the parent and the child get an instant text whenever the card is used. You let your kid know the ground-rules and repercussions for violating them (a penalty or a “financial time-out” by locking the card) and you let them know you’ll see usage alerts in real time via text message.

If you need a more restrictive approach, consider using this two card setup.

Tip: Start a Spend Now, Spend Later System for Smarter, Safer Spending.

Tip: Use parental money controls for transparency training not micro-management.

What does it mean when there’s an asterisk next to a card balance?

On rare occasions, the running balance calculated by FamZoo for a card won’t match the latest balance reported for the card by the underlying payment platform. This is typically a temporary condition due to brief delays in the overall system. Whenever FamZoo detects this situation, we’ll display an asterisk next to the balance to indicate that there is a mismatch. To be safe, places in FamZoo that show a single balance will show the minimum of the FamZoo calculated balance and the card balance last reported by the payment system. If the mismatch persists for more than an hour after refreshing the page and the card balance, please contact us, and we’ll investigate the source of the mismatch.

Our card has a negative balance! How is that possible?

A negative balance results when a merchant authorizes your family member’s card for a certain amount, but then later settles the purchase for a greater amount that exceeds the card’s current balance. A classic example: you’re paying for a meal in a restaurant, and the waiter initially authorizes the card for the amount of the bill — say $9 — but then you generously add a tip of $2. If the card had a balance of $10 before paying for the meal, it will end up with a balance of -$1 afterwards when the payment ultimately settles. (The $10 starting balance minus the $9 bill minus the $2 tip equals an ending balance of -$1.)

Attempting to make any additional purchases on a card with a negative balance will result in declines, so you’ll want to transfer enough funds to get the card balance back above zero as soon as possible.

What is a partially settled transaction?

A partially settled transaction is one in which the final amount will be adjusted 30 days after the initial purchase. It usually applies to an online purchase when the merchant could only ship some of the items from the overall purchase. The merchant then claims from the preauthorized amount, via a partial settlement, the amount equal to the price of the shipped items. Unfortunately the merchant still has a hold on the remainder of the preauthorized amount for 30 days after the purchase, and those funds are not available for spending by the cardholder until the hold is released after the 30 days.

Loading Funds onto Your FamZoo Cards

How do I load money onto my FamZoo card?

First things first: we never PULL money from your bank account. So you don’t set up reload from inside the FamZoo app(lication).

Instead, you always PUSH money securely into FamZoo.

Unless you’re reloading with cash or an instant transfer, you set up reload by providing your card’s routing and account numbers to your bank, credit union, digital wallet, employer, or government agency. You never enter your bank info into FamZoo. Why? Short answer: security. Longer answer: see here.

FamZoo supports numerous secure ways to load additional funds onto your card.

Before reloading, note the daily load and total balance limits here.

Please read the details and options for reloading on our Reload Help Page.

Note: Most parents load only the primary funding card and use the FamZoo app(lication) to move funds to other family member cards instantly. But there are times when loading the other cards directly is handy — like loading a teen’s card via direct deposit from a summer or part-time job. Our load options work for any FamZoo card.

Here’s a summary of the most popular options (be sure to check out the Apple Pay option if you have an iPhone):

| Option | Summary | Speed | Cost |

|---|---|---|---|

| Bank Transfer | Transfer funds from your bank account to your card using your bank’s or credit union’s online banking service or Xoom. | 1-3 Business Days |

Often free. Some banks charge a fee. |

| Direct Deposit | Instruct an employer or government agency to deposit funds on your card. | 1-5 Business Days |

Free |

| Load cash onto your card at a participating retailer. | Minutes | Typically $4.95 | |

| Transfer funds from Apple Pay (typically 1 business day), PayPal, or Square Cash to your card. | 1-3 Business Days |

Free | |

| Digital wallet instant transfer | Immediately transfer funds from PayPal, Apple Pay, or Venmo. | Minutes | 1.5% - 1.75% fee. Min $0.25. Max $10 - $25. |

Important: You cannot deposit cash onto your card from an ATM. To load your card with cash, see our cash load options.

How do I find the routing and account numbers for direct deposit or ACH transfers?

Each FamZoo card has a separate set of bank routing and account numbers (distinct from the number on the face of your card) that makes the card electronically accessible as a checking account. That means you can have bank transfers, paychecks, tax refunds, and more delivered right to your card. You can also set up direct debits from your card.

Once you activate your cards, you can access the routing and account numbers (as well as the card billing addresses) via the Card Information screen as follows:

- Sign into FamZoo as a parent.

- If you are in our Desktop UI:

- Select the Bank ⟩ Accounts menu item to get to the Accounts listing.

- Click on the desired card’s balance to get to its Transactions listing.

- Click or the Card Information link in the left hand sidebar.

- Otherwise, if you are in our Mobile UI:

- Tap on Accounts along the bottom of the screen.

- Tap on the desired card’s balance to get to its Transactions listing.

- Tap on the Card Information entry of the menu in the upper right corner of the screen.

Tip: 11 Numbers Kids With Prepaid Cards Need To Know.

I lost my direct deposit form. How can I get a new one?

If you misplaced (or prematurely shredded) the card carrier with your direct deposit form, please contact us and we can email you a printable PDF.

Where do I find the two trial deposits during verification?

Many load methods (like bank transfer and PayPal) require a one-time verification process that involves identifying two small trial deposits on your card. Each will be less than a dollar. You prove you are the card owner by finding those two deposits and reporting the amounts back to the payment provider or financial institution. Here’s how you can find the amounts in FamZoo after they have been sent (which often takes a couple of days):

- Sign into FamZoo.

- Visit the Accounts or Overview page.

- Locate the prepaid account for the card you are attempting to load.

- Click on the balance amount to get to the Transactions page.

- Scroll through the history until you see the two transactions for the trial deposits.

Alternatively, you can enable activity alerts for your card, and you’ll receive text or email messages containing the amounts as soon as they appear.

When will transferred funds appear on my card?

Short answer: 1 to 3 business days (unless it’s a transfer within FamZoo between cards in your family — which is instant).

Long answer...

Using your card’s routing and account numbers, you can establish a link between your FamZoo prepaid card account and your financial institution or digital wallet. Once linked, you can transfer funds between the two. The type of transfer performed is known as an ACH transfer.

When you initiate a transfer, the funds are deducted from the sending side immediately. 1 to 3 business days later, the funds will be credited to the receiving side. That excludes weekends and bank holidays. (Why does it take so darn long? There’s a good summary here and even a whole NPR episode on it here.)

Our card processor reviews first time incoming transfers each business day by around 11:00AM Eastern time. First time transfers may be delayed by a few additional hours for extra security verification (like if account owner names don’t match up cleanly). So, if you don’t see an incoming transfer by late morning, you’ll want to look for the deposit on the next business day. If you don’t see your transfer after 3 business days, please contact us so we can investigate.

For the fastest transfer times:

- Start early in the day. Banks tend to have a cutoff time after which transfers are held until the next business day for initiation.

- Start early in the week. Weekends do not count as bank business days and will extend the elapsed time.

- Plan around holidays. Holidays do not count as bank business days and will extend the elapsed time.

- Try Apple Pay. If you have an iPhone, try the Apple Pay reload option described here. Parents consistently report next business day load times.

Need to load funds immediately in a pinch? Try loading with cash as described here.

Can I wire funds to a FamZoo card?

No. Our card processor cannot process wire transfers. Any attempt to wire funds will be rejected. You may even get stuck with a wiring fee from the initiating financial institution for up to $30.

FamZoo cards do however handle ACH transfers using their associated account and routing numbers. See our FAQ entry for Bank Transfers.

How can I unload funds from my FamZoo card?

There are several ways to remove some or all of the funds remaining on your FamZoo card.

Important: If you are cancelling your FamZoo account, you’ll want to consolidate any outstanding card balances onto your primary funding card first. Then lock the other cards in the family to prevent any automated movement of funds while you are “unloading” your consolidated balance.

You can move funds off your card using any of these options:

- If you are cancelling and have a PayPal or a Zelle account and the amount is $500 or less, contact us. Let us know the email address or username you have on file with PayPal or the email or mobile phone number associated with your Zelle account. We can send the funds to you and close out your FamZoo account for you.

- If you are cancelling and you have a small balance remaining that you’d like to leave as a “tip” (thank you!), please mention that explicitly in the Reasons/Comments field of the Cancel Membership form.

- If you are an Amazon customer, reload your Amazon.com Gift Card balance with the amount remaining on your FamZoo card (must be at least $0.50). Just choose the custom amount option on the Amazon reload page, enter the amount remaining on your FamZoo card, and complete the purchase with your FamZoo card.

The next time you make an Amazon purchase, you’ll be able to split payment between your Amazon.com Gift Card balance and your normal payment method.

See detailed steps and screenshots here.

- Withdraw funds at an ATM and/or spend any remaining balance down to zero.

- If you have been loading your card via bank transfers, you can typically sign into your online banking and execute a transfer in the opposite direction from your linked FamZoo card account back to your checking account.

- If you have an Apple device, you can move money from your FamZoo card into your Apple Cash balance using the instructions here.

- If you have been loading your card via PayPal, you can sign into PayPal and execute a transfer in the opposite direction from your linked FamZoo card account back to your PayPal wallet.

- If your remaining balance is less than or equal to any recent payments you have made to us, contact us. We can often return the funds by issuing a refund to the card used for your payment(s).

- If you are cancelling, we can have our card processor issue you a check to the address on file with your card. Contact us to confirm your address. Please be aware that the check has a security measure that requires the bank teller to call our card processor with a printed code. So, you physically have to go to your bank to deposit it.

Reimbursing Expenses for Family Members

How does reimbursing expenses work in FamZoo?

Any family member can request reimbursement of an expense using funds from the family’s primary funding card. In FamZoo, an eligible reimbursable expense is any debit transaction on any family member’s prepaid card other than the primary funding card.

If the family member requesting the reimbursement is a child, the request can be routed to any parent in the family. If a parent requests a reimbursement, the request is always sent to the cardholder of the primary funding card.

The reimbursement request is delivered to the designated recipient via an email and a text message. Each contain a link that can be clicked to approve or deny the request. If approved, the specified amount (which may be more or less than the original amount requested) is transferred from the primary funding card to the card that incurred the expense. The reimbursement transfer results in a debit transaction on the primary funding card and a credit transaction on the reimbursed card. Both transactions send out activity alerts (if enabled).

To learn more about how to handle a typical reimbursement scenario in FamZoo and get a glimpse of the application screens involved, check out this blog post.

Tip: Reimburse your kid’s expenses afterwards instead of paying up front.

Tip: Use reimbursements to encourage this good money habit.

Tip: Reimburse your teen’s Uber and Lyft rides.

How does a family member request a reimbursement?

To request reimbursement for an expense, a family member can follow these steps:

- Sign into FamZoo.

- Navigate to the Transactions page for the prepaid card account containing the expense for which a reimbursement is desired.

- Find the transaction corresponding to the expense.

- Bring up the Request Reimbursement form:

- In the desktop interface, hover the mouse over the transaction, and click on the green arrow icon that appears.

- In the mobile interface, tap the arrow beneath the transaction amount. If the family member has permission to edit the transaction (as is the case for parents), an additional tap will be required on the Request Reimbursement link appearing near the top of the Edit Transaction form.

- Fill in the fields to select a recipient for the request (only relevant for kids), indicate the desired amount, and supply a reason for the request.

- Submit the form to send the request off to the recipient.

How do I approve or deny a reimbursement request?

You’ll be notified of reimbursement requests from other members in your family via an email and a text message from FamZoo. To approve or deny the request, click on the link at the bottom of the email or at the end of the text message to get to the Reimburse This? form.

Alternatively, if you do not have the email handy, you can navigate to the Reimburse This? form as follows:

- Sign into FamZoo.

- Find the expense with the reimbursement request pending in the Transactions page of the appropriate prepaid card account.

- Bring up the Reimburse This? form.

- In the desktop interface, click on the Reimbursement Pending status label.

- In the mobile interface, tap the arrow beneath the amount, and then tap on the Reimburse this? link near the top of the Edit Transaction form.

Once you’re on the Reimburse This? form, fill in the fields to indicate the reimbursement amount (if any), whether the request is approved or denied, and any message you might have for the requesting family member. Submit the form to finish handling the reimbursement.

Can I reimburse an expense without waiting for a request?

Yep. You don’t have to wait for your family member to request a reimbursement in order to pay them back. You can go right in and initiate a reimbursement yourself. Just:

- Navigate to the desired expense in the Transactions page for the card upon which the purchase was made.