Declines on kids’ cards are embarrassing, frustrating, inconvenient, and ... most of the time, easily avoided.

How do I know?

I just looked at our decline data for the last week.

The overwhelming majority of declines — 62% — are due to insufficient balance on the card. The fix?

Coach kids to:

- Check their balances in FamZoo before purchasing.

- Stop signing up for subscriptions and services they can’t afford. Note that services like iTunes will keep re-billing for unpaid purchases and racking up declines until they can collect what is rightfully owed.

- Read the free trial fine print, and cancel unwanted services by the deadline. Kids get snared by unwanted upgrades. All. The. Time. Amazon Prime, Uber Pass, Instacart+, you name it. Help them identify and resist the sneaky upsell traps set by merchants.

- Avoid hefty unexpected preauthorizations at the pump ($75 or more!) when buying gas by paying ahead at the cashier.

The second most common cause of declines (23.1%) is entering an invalid billing address. The solution? Teach your kids how address verification works. If you can’t figure out an address verification issue, be sure to contact us so we can look up the mismatch details in our card processor’s system.

The remaining decline reasons are all in the single digit percentage range. Most are all about the numbers: wrong PIN, wrong expiration date, wrong security code. Be sure to review all the numbers on the cards with your kids before turning them loose for their first purchases.

Other miscellaneous decline reasons include:

- trying to use a locked card,

- using an old replaced card instead of the new one (often by forgetting to update a billing profile stored online), or

- trying to use a card with a PIN security block in place due to 3 or more incorrect PIN entries in the past.

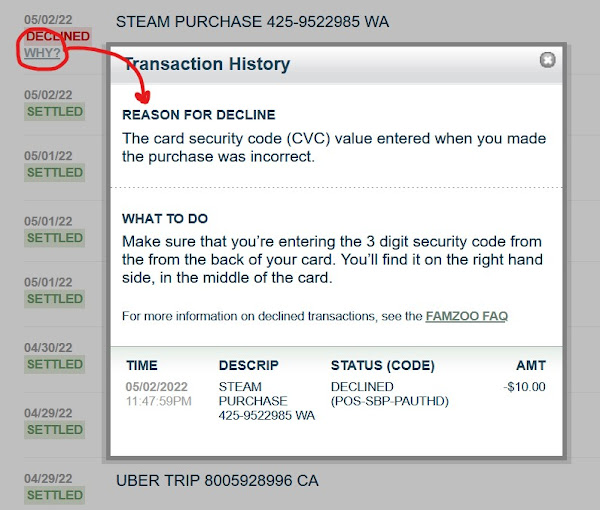

For all of these cases, you and your kids can see the reason for declined transactions right in FamZoo. Here’s how:

- Click or tap on the balance for the declining card to get to its Transactions listing

- Locate the declined transaction in the listing.

- Click or tap on the Why? link under the red status box next to the declined transaction to launch the Transaction History screen.

The screen includes the reason for the decline, how to address the problem, and the attempted amount.

What if no declined transaction appears in the listing, even several minutes after the attempt? It could be an issue with the merchant’s Point Of Sale device, a rare network outage (consult our System Status page), or a physical problem with the card.

If you think the card’s chip might be damaged, try polishing it lightly with a cloth. As odd as that sounds, sometimes it does the trick. If not, contact us for a replacement.

To guard against the unusual situations where there’s no quick fix, coach your kids to always have a plan B for payment — an emergency stash of cash, a backup card, a digital wallet like Apple Pay, or a buddy who can be reimbursed later 🙂.

Here are a few final tips for how you can help your kids eliminate unnecessary declines:

- Turn on activity alerts to stay on top of declines and provide coaching in real-time.

- Give bonuses for decline-free streaks. 🥕

- Assess a parent-imposed overdraft penalty. 📏

- Make teens pass the 6 month Zero-Decline Challenge before graduating to a traditional bank account or a credit card.

Newer Post

Newer Post

Post a Comment