Where does money come from? That’s a silly question — just ask any little kid and you’ll get the obvious answer:

“It pops out of a machine that my mom visits.”

“It lives on a magical card in my dad’s wallet.”

“It comes from my mom’s iPhone.”

Uh oh...

You can’t really blame little kids for these answers. They’re just explaining what they see every day. They’re connecting the only dots you’ve given them.

Chapter two of the book Smart Money Smart Kids is all about dispelling the money-is-magical myth for kids and getting them to understand this critical connection:

“Money comes from work.”

(Why am I reading the new book by Dave Ramsey and his daughter, Rachel Cruze? See the first post in this series here.)

The chapter walks through the way the Ramsey’s created and reinforced the work-money connection in their family. It’s an excellent age-appropriate blueprint that balances nicely between working “on commission” to earn money and working pro-bono to fulfill one’s responsibilities as a family member. In fact, there’s a common misconception that the Ramseys advocate paying kids for every single chore around the house. That simply isn’t the case, and the myth is nicely dispelled in this chapter. As Rachel says: “You want your kids to understand that money comes from work, but you don’t want to go so far that they end up thinking they should get paid for everything they do around the house.”

Here are some more favorite quotes from the book about the work-money connection:

- “Work creates discipline, and when you have discipline in your life, you are a healthier person.”

- “The basic principle of working is one of the best ways to combat the attitude of entitlement.”

- “Working for it makes every purchase—even a toy or video game—feel like an accomplishment.”

- “If Mom and Dad are the only ‘bosses’ children know, they won’t have the chance to learn other important lessons about working for — and with — other people.”

- “When you don’t teach your kids to work, you are not being kind or gracious; you are being irresponsible.”

My only minor quibble with the Ramsey recipe is the unequivocal blasting of “allowance.” It’s a hot button word for Dave. He feels the “A” word conditions kids to feel that “life makes allowances for them,” and he urges readers to remove it from their family lexicon. I appreciate the sentiment, but I think allowance can be an effective tool for teaching a young child to budget for specific needs that she can’t reasonably afford just yet — like clothing. Giving a young tween or teen a clothing allowance that hews to a strict budget is an excellent financial decision making experience. I suspect if we just substituted the word “budget” for “allowance,” we’d all be on the same page.

Also note that this doesn’t have to be an either-or choice. There’s no reason you can’t mix and match the two. For example, you can easily combine a budget-based clothing allowance with commissioned jobs. The commission payments would cover all your child’s discretionary expenses (i.e., wants). Kids are smart enough to understand the distinction between an allowance that represents a carefully planned budget versus one that’s simply a mindless handout. Furthermore, they’ll appreciate the added responsibility and ownership that come with managing a set of necessary expenses rather than relying on parents to make those decisions on their behalf.

That detail aside, I’m all in on the core theme here: the sooner your kids gain a firsthand understanding of the direct relationship between work and money, the better off they’ll be. Connect the work-money dots for them explicitly; otherwise, they’re liable to act like money does just magically spew out of ATMs, credit cards, and iWhatevers.

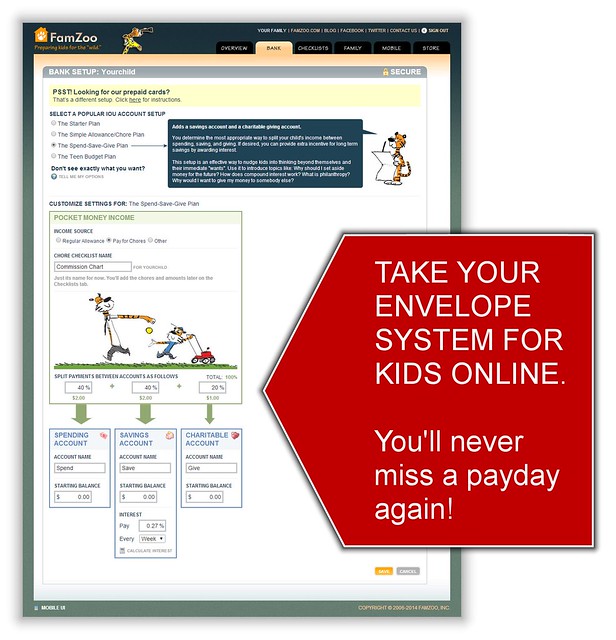

P.S. Dave confesses that 25% of the time he found himself saying on payday: “I forgot to go to the bank and get the one-dollar bills, so we’ll make it up next week.” If you find yourself doing the same, you might want to check out FamZoo. We make sure that never happens. What would you think of an employer who only delivered your paycheck 75% of the time?

Click here to go to the next post in the review series: Striking a Balance with Kids and Money

The full series:

- Teaching Kids Good Money Habits the Ramsey Way: Introduction

- Setting a Good Money Example for Your Kids: Sufficient? Necessary?

- Connecting the Dots Between Money and Work for Your Kids

- Striking a Balance with Kids and Money

- 4 Big Things Your Teen Can Save For

Newer Post

Newer Post

Post a Comment