“@#$%&!* taxes!”

Is that the extent of the “discussion” you have with your kids about taxes each year?

You’re not alone. Most of us send exclusively negative tax messages to our kids with our subtle or not-so-subtle demeanor throughout the filing season. At minimum, kids in a typical family might overhear an expletive or two (or ten!) reverberating throughout the house in the days leading up to the universally despised April 15th deadline.

Expletives aside, have you ever taken the time to really explain what taxes are all about? Can you blame your kid for thinking that taxes are just some vague evil thing that make mom and dad grumpy? We’re doing our kids a disservice when we keep them in the dark about the what and why of taxes and how to handle them. Need more convincing? Check out Neale Godfrey’s thoughtful piece in Forbes: Life Is Taxing... Teaching Your Kids Real Financial Facts.

Here are a few ideas for shedding some light on taxes for your kids:

Give your kids a taste of tax pain. Try the Conan O’Brien method: “Just taught my kids about taxes by eating 38% of their ice cream.” Ha, ha, just kidding. They already know taxes suck because of all your ranting around the house, so you can skip to #2.

Give your kids a taste of tax pain. Try the Conan O’Brien method: “Just taught my kids about taxes by eating 38% of their ice cream.” Ha, ha, just kidding. They already know taxes suck because of all your ranting around the house, so you can skip to #2.- Throw a tax category into the spend/save/give mix. Lots of parents teach the basics of saving and charitable giving by having their kids set aside percentages of their “income” from allowance, chores, or birthday checks into three jars. Why not add a tax jar too? (FamZoo families can easily add an extra account to track the taxes and adjust the child’s splits accordingly.) Explain that the accumulated taxes will be used for things that benefit the whole family, like a night out at the movie theater, a dinner at a local restaurant, or a vacation expense.

- Prepare your teen for the shock of paycheck deductions. The Net Pay column on your teen’s first paycheck can be a real buzz kill, especially if she’s already spent the Gross Pay amount in her mind. Soften the blow ahead of time by sitting down and watching this two minute tour of a paycheck.

- Walk through Free File with your working teen. Most working teens will be eligible for the IRS Free File program and will have a straightforward tax situation easily handled by one of the participating online filing programs like TurboTax. This is a great opportunity to teach your teen the basics of preparing taxes by walking through the screens together. Doing taxes isn’t exactly at the top of every teen’s fun list, so be sure to mention the part about the refund. (Most working teens will be in a position to get one, and FamZoo kids can even have it direct deposited to their cards.) In my experience, teens actually get pretty jazzed when they see the refund amount accumulating in the corner of the TurboTax screen. It’s almost like a video game. Who knew doing taxes could be so fun?

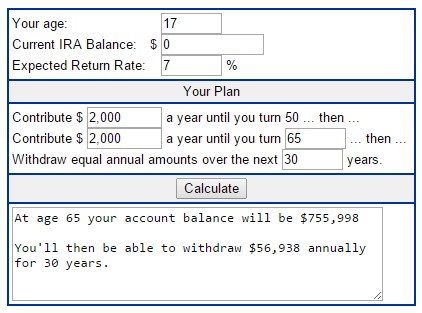

- Teach your teen to be a tax savvy investor. Instead of blowing that refund from step 4 on pizza, talk your teen into doing something really genius instead, like contributing her windfall to a Roth IRA. Explain that a Roth IRA allows her money to grow tax free in a special account and ultimately pull it out and spend it tax free too...when she’s an old geezer. OK, so you may have to work on your salesmanship when it comes to that last bit. Fire up an online calculator and run through a few scenarios to show her the money.

Offer to sweeten the pot by matching her contributions. With your boost, the calculator should really drive home the awesome power of compound interest. The whole arrangement is what we call a “Family 401(k)”, and it’s my all-time favorite family finance tip. Read more about it here.

Offer to sweeten the pot by matching her contributions. With your boost, the calculator should really drive home the awesome power of compound interest. The whole arrangement is what we call a “Family 401(k)”, and it’s my all-time favorite family finance tip. Read more about it here.

As for the swearing about taxes, don’t worry about any coaching on that one. They’ll figure it out on their own.

P.S. Disclaimer: this article is for informational purposes only and in no way should be relied upon for financial, tax, or legal advice. Be sure to consult your own financial, tax, or legal advisor when making decisions regarding your family’s financial management.

Newer Post

Newer Post

Post a Comment