Are you stuffing your child’s savings in a bank account because you’re afraid of the stock market? If so, what do you suppose the annual return after inflation will be? Minimal. In fact, it may be negative.

Whether you’re a millennial or not, you might want to check out this excellent article in the Wall Street Journal: The Market Is Your Friend. Really: A Millennial’s Advice to Peers. First, it explains why the fear that millennials (and perhaps you) have about investing in the stock market is quite understandable. Second, it explains why they (and perhaps you) really need to get over it! The bottom line: 6.8%. That’s the average annual return after inflation that the stock market has earned since 1871, and that’s in the face of 29 recessions, 1 Great Depression, 2 world wars, and plenty more disasters. If you’ve got time on your side, you’re going to be hard-pressed to find a smarter long term investing strategy than a low cost US stock market index fund. And, fortunately, time is one thing your kids have in spades!

What if your young child doesn’t have enough money to make a minimum investment? One technique I’ve used is to track my child’s savings in our virtual family bank where it earns a nice hefty dose of parent-paid interest. Once it builds up to an amount that clears the minimum hurdle, I roll it over to a real world investment account. Then I rinse and repeat.

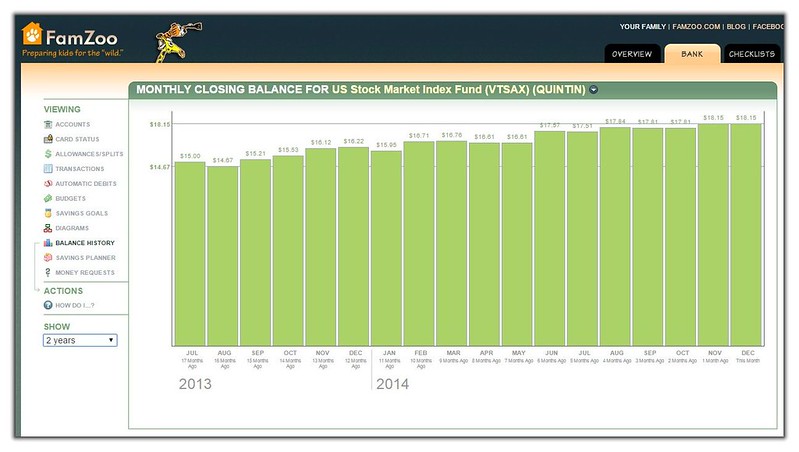

What if you don’t want to hassle with setting up a custodial account, but you still want to teach your youngster about investing in an engaging way? You might consider setting up a parent-paid investment account like I did for my youngest. Here’s the trend chart for his mock VTSAX account in FamZoo:

When do you think your kids are old enough to start learning about investing? Perhaps younger than you might assume. Check out the first entry in my remaining favorite family finance articles for the month of November:

- A Stock Portfolio at Age 6? — Mrs. 1500 makes the case for teaching kids how to invest in stocks as early as age 6. I agree that kids can start to grasp these concepts at a very young age given enough repetition. Look at the complicated computer games kids absorb with seemingly zero effort. I have no idea why some folks vastly underestimate the intellectual potential of kids. Maybe it’s a control thing. In any case, the one point I’d be sure to drive home with kids is the critical importance of diversification. 99% of people are best off investing in a market index like VTSAX and forgetting about it. Investing in an individual stock or two that a kid can relate to makes a lot of sense from an interest and learn-the-mechanics standpoint, but I worry that — in the absence of additional education — they’ll be fooled into thinking they can outsmart the market if they get lucky, or, conversely, spooked from investing if their pick goes South.

- Allowance To Teach Child Importance Of Parental Dependence — The Onion weighs in on the importance of an allowance. Bwahaha!!! Some good satire here. (Seriously though, that’s why an allowance should be designed as a budget, not an entitlement!)

- Olive Us Episode 1: Garden Day — I stumbled upon Olive Us, a video series created by Ben and Gabrielle Blair featuring their six kids. The first episode — “Garden Day” — is a beautifully done 5 minute video that may inspire your kids to do chores. OK, well, even if it doesn’t, it’s very worth watching. I’m looking forward to checking out the rest of the series.

- Sex, Limes and Financial Education — A terrific post from the wonderfully entertaining personal finance blogger, Mr. 1500. He discusses some of the reasons behind the sorry state of youth financial education, the odd rationale some folks pull out of their...umm...hats to take the position that it isn’t important anyway, and what his FinLit game-plan is with his own kids. On the parents-teaching-kids-about-money front, we think one huge additional reason parents struggle to get it done is that they are insanely busy. It’s just really hard for most folks to follow through consistently when they’re getting crushed between work and family obligations. And, unfortunately, that frenetic period often coincides with the formative ages of their children. That’s why we think parents can benefit from simple automated systems that help them deliver consistent messages to there kids with minimal effort.

- Teaching Our Children About Money — Another excellent essay on why we should teach our kids good money habits. I’d add that another fundamental reason why parents should equip their kids with basic personal finance skills and good money habits (like building and maintaining an emergency fund) is that money problems are often a top source of stress in life. 2014 research from the American Psychological Association listed “money” as the number two cause of stress in the U.S. behind “job pressure” and ahead of “health.” So, if for no other reason, teach your kids the basics of money management (using suggestions like the ones in the essay) to help them avoid additional stress in their adult lives.

- Honey, Do You Want To Be Rich? — Do you want riches or just freedom? This post should prompt a thoughtful discussion with your kids. I love the Vonnegut poem, even if it doesn’t have any rhymes. A related quote from Henry Rollins to discuss with your kids: “The more you own, the more it owns you.”

- Teaching Teens About Money — Tracie Shroyer shares several excellent teen money tips in this 6 minute TV interview: pay-as-you-go cell phone plan, allowance as a budget, partial bill sharing for expensive sports or activities, emergency car fund, and shifting expense responsibility to your teen as part-time work income increases. Watch the video to get the thoughtful rationale on each — clearly based on real world experience. (BTW: I think a prepaid card works just as well as cash!)

- Austin’s Allowance — If you’re thinking of giving your youngster an allowance as a way to start teaching basic personal finance skills, this is a terrific book to read together beforehand. It will help you set expectations and provide some initial guidance about fundamental topics like delaying gratification, resisting peer pressure, making financial trade offs, saving, and philanthropy. It’s a warm story with delightful illustrations. And, it promotes a good cause. Bonus.

- Can Money Buy Happiness? Here’s What Science Has to Say — The latest research on the link between money and happiness indicates:

- People with higher incomes are generally happier than those who struggle to get by, but how people spend money matters much more.

- Giving money away makes people happier than spending it on themselves.

- Spending money on experiences makes people happier than spending it on material goods (nonetheless, people prioritize material goods over experiences when money is tight because they overestimate the lasting value of the former due to “hedonic adaptation” and underestimate the lasting value of the latter!)

- Experiences give a greater sense of connection, form a bigger part of our sense of identity, and are less subject to comparison with others relative to material goods.

- Consciously practicing gratitude, moving your stuff, and sharing your stuff can damp the effect of hedonic adaptation.

- Younger Generation Faces a Savings Deficit — More interesting data on savings from Moody’s Analytics. Savings rates popped up into positive territory during the recession, but are headed down again, and the under 35 millennial generation is already in negative territory (-2%). Their median net worth is on the decline, and their student debt is on the incline. Not cool. Most disturbing quotes: Twenty-six year old Emily Turner proclaims: “part of youth, the wiring of a young person, is the focus on really short-term gratification.” Ugh! FamZoo is all about changing that “wiring” early. Curtis Holland, 30, laments: “Investments are too complicated. I don’t know the risks. I don't know the benefits.” And that’s from a (presumably highly educated) software developer! Oof. Two words for Curtis: Index Funds! Parents, teach your kids the basics early so we can start reversing this disturbing trend through simple, positive money habits.

- How to Raise a Money Smart Child — Chief Money Mammal, John Lanza, weighs in on the debate about whether allowance should be tied to chores. John is not a fan on the grounds that it tends to increase the negativity that is so often associated with money. We tend to favor the hybrid model of unpaid expected chores, a modest regular allowance (ideally based on a budget), and paid odd-job opportunities.

- The Child Who Declares “I Want to Be Rich” — Your kid proclaims: “I want to be rich!” Is that bad? Has all of your commentary on values and money fallen on deaf ears? Has all of the materialistic social modeling going on in today’s world overwhelmed your parental messaging? Has your tenuous financial situation created a sense of insecurity in your child and prompted that desire? Well, ask your child (but with the right tone). It’s a good opportunity to have a meaningful conversation. A thought-provoking article from Ron Lieber.

- Magical Cleanup Tricks for Parents — Getting youngsters to pick up after themselves can be a real chore. This article offers some good tips:

- Model behavior by “looking like you’re having fun” when you pickup. (Chuckle.)

- Offer an incentive, like going to the park.

- Turn cleanup into a game.

- Be explicit that you are asking for their help, and that you appreciate it.

- Use “we” language.

- Use a signal, like ringing a bell (how Pavlovian!) 5 minutes before cleanup.

- Label shelves and bins according to what goes where. Use pictures for the youngest kids.

- How One Woman Manages To Give 10% Of Her Income Away Each Year — A very thoughtful reflection on giving by a young adult. My dream for FamZoo families is that if kids are routinely having a fraction of their allowance/chore payments directed to charitable giving accounts as youngsters, then making philanthropy a line item in the budget will come naturally as a young adults. That’s essentially how it worked out for Allison, the author. My favorite quote: ”I put my money where my values are.“

Newer Post

Newer Post

Post a Comment