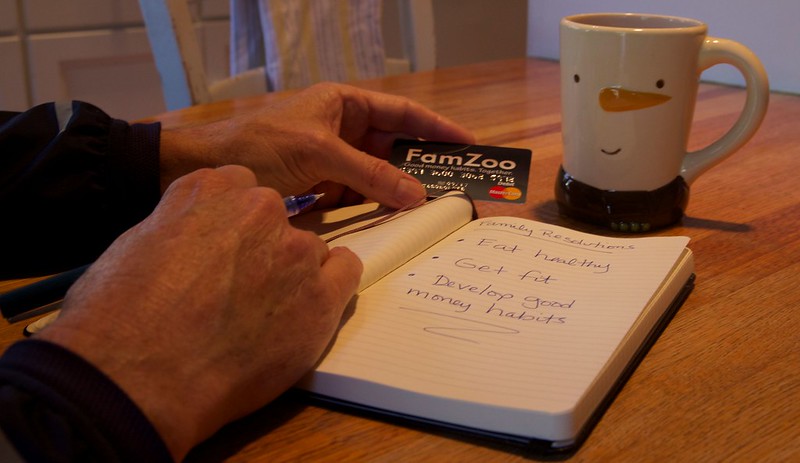

Prepaid card accounts and bank sub accounts are perfect for automatically building up little “buckets” of savings. Family members young and old can set up automatic deposits, allowance splits, or transfers that drip funds into special purpose accounts week after week. Just set it and forget it. After a while, you’ll have much more than a drop in the bucket.

Here are 5 savings buckets to consider setting up in your family as you kick off the new year:

- Emergencies — it’s never too early to learn the importance of having an emergency fund. Kids break things, teens get parking tickets, and, as every adult knows, stuff happens! Why not teach everyone in the family the importance of maintaining an emergency fund before the stuff hits the fan?

- A minimum investment — with near zero interest rates, putting long term savings in a bank savings account doesn’t make a ton of sense. The problem is: most decent investments involve a significant initial investment hurdle that prevents kids and even many adults from getting started. $500 is often the lowest you’ll find. So, start a savings bucket for building up enough funds to make a minimum investment, and roll the funds over as soon as you clear the hurdle.

- Next year’s holiday gifts — the holidays can be a financial strain for all ages with unplanned gift spending tanking the budget. If you start automatically setting aside small sums early on in the year, you’ll have a nice holiday nest egg set aside by the time December rolls around. Stress-free gift giving. Sweet.

- Next summer’s vacation — how can you turn your family vacation from a budget busting entitlement into a family bonding experience that everyone appreciates? Let everyone contribute! Create a common family vacation fund that everyone (yes, the kids too!) pitches into regularly from the start of the year.

- Philanthropy — challenge everyone in the family to divert a portion of their regular income into a donation account each pay cycle. Then, pick a day on the calendar toward the end of the year to hold a family giving meeting where everyone decides where to deploy their charitable funds. Make it an annual tradition in your family. Careful, this exercise could make your family high!

Do any of those savings buckets make sense for your family? Can you think of some other good ones? Please share.

Set up a little automated drip savings bucket or two for your family today. It’s a super easy way to cherry pick at least one New Years resolution off your list. As for losing weight, falling in love, and those other top 10 resolutions — sorry, you’re on your own!

Related Post: 10 Good Money Habits to Teach Your Children This Year.

Newer Post

Newer Post

Post a Comment