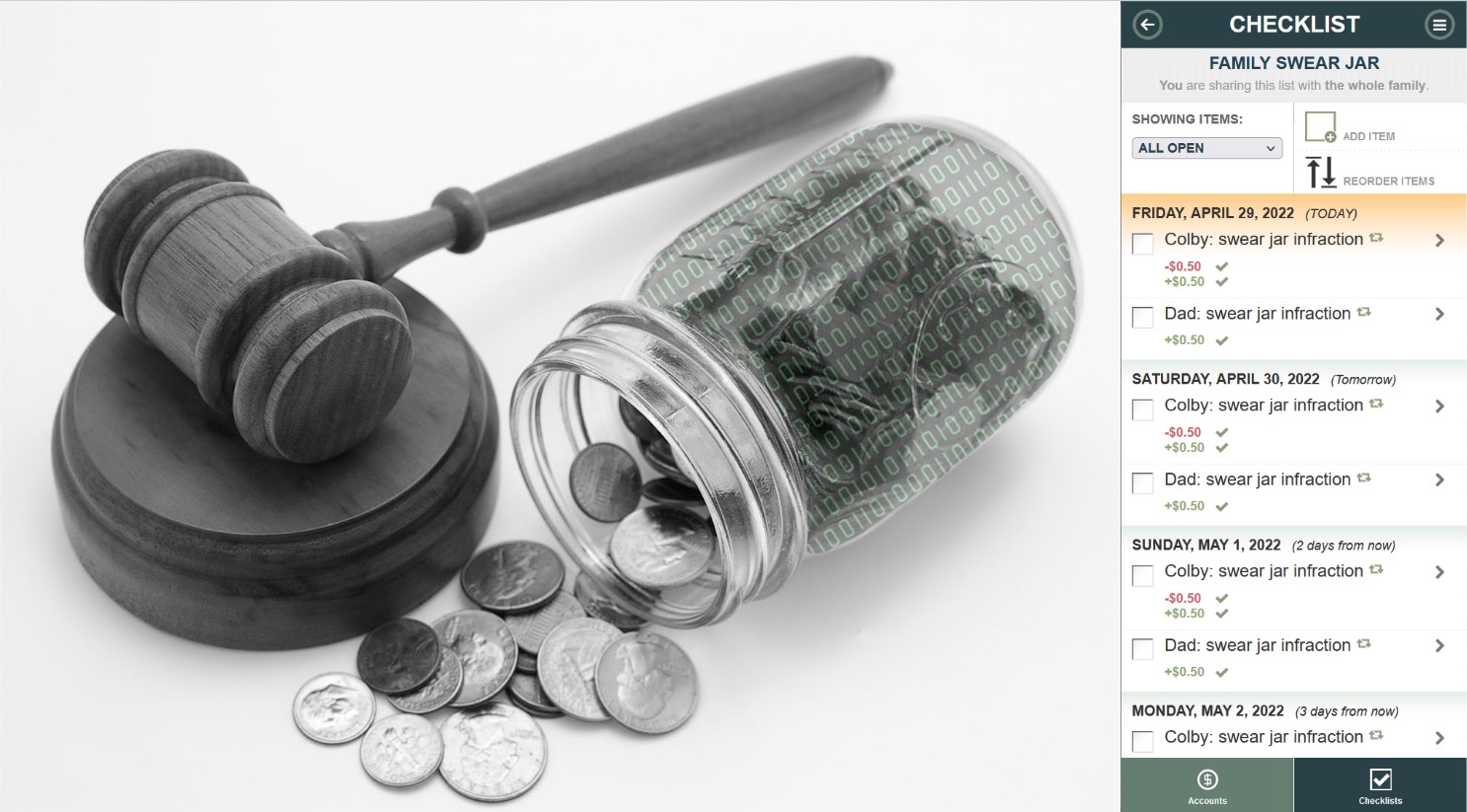

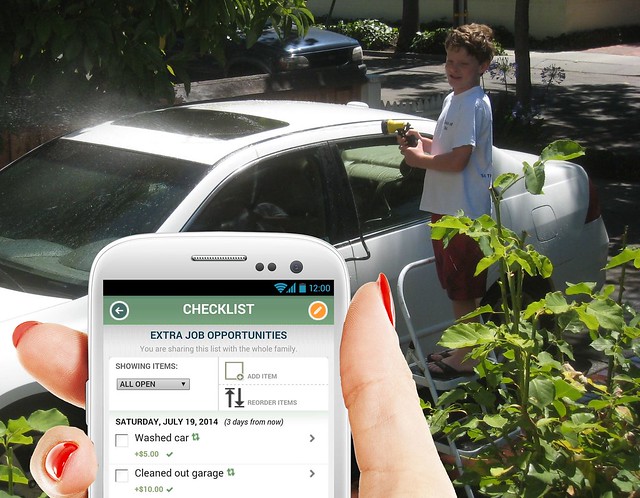

Suppose you’re setting up a checklist item that delivers a reward. (Think chore charts for the kids.) You need to specify where that reward should be delivered when the item is completed. Should it be credited to Johnny’s spending account? Should it be credited to Suzy’s spending, saving, and giving accounts using her spend/save/give split?

Choosing an explicit target account is fine when you know up front who should receive the reward. But what if the opportunity is first come, first serve? You want the kid who checks off the item first to earn the credit. Families often call this a “First Dibs” Chore Chart.

In the past, we had a clunky workaround for first dibs chore charts. The parent had to create separate items for each of the kids and then trust that only one kid — the deserving kid — would check off the right item. What could go wrong? 😬

Now we have a more elegant solution. We introduced a new target destination for rewards and penalties on checklist items. It’s called the Default Account. If you want a chore reward to go to the first child who completes it, set the target account to the Default Account entry. Later, when the first child checks off the item, we’ll look up that child’s default account setting and apply the reward to it.

Here’s how to set it up step-by-step.