On November 11, the venture-backed youth prepaid card startup, Nickel Labs, announced it was folding up shop. As of December 11, 2016, families will no longer be able to use the Nickel cards or services.

I’m saddened to see them go. Nickel was clearly a thoughtful, mission-driven player in the youth prepaid card space. They garnered some ardent admirers during their brief run. The youth financial literacy market needs more earnest players like Nickel, not fewer.

Nickel didn’t indicate why they’re shutting down, but as a 10 year veteran in this space, I can tell you it takes (borderline insane) dedication to the mission and tremendous patience to build a business. It’s a fledgling, yet — I believe — promising, market. It simply may not be sufficiently ripe for venture-backed startups (like Nickel) or established players (like PayPal with their recently defunct Student Accounts). Yet.

Timing is everything in new markets. Lots of runway and patience sure helps.

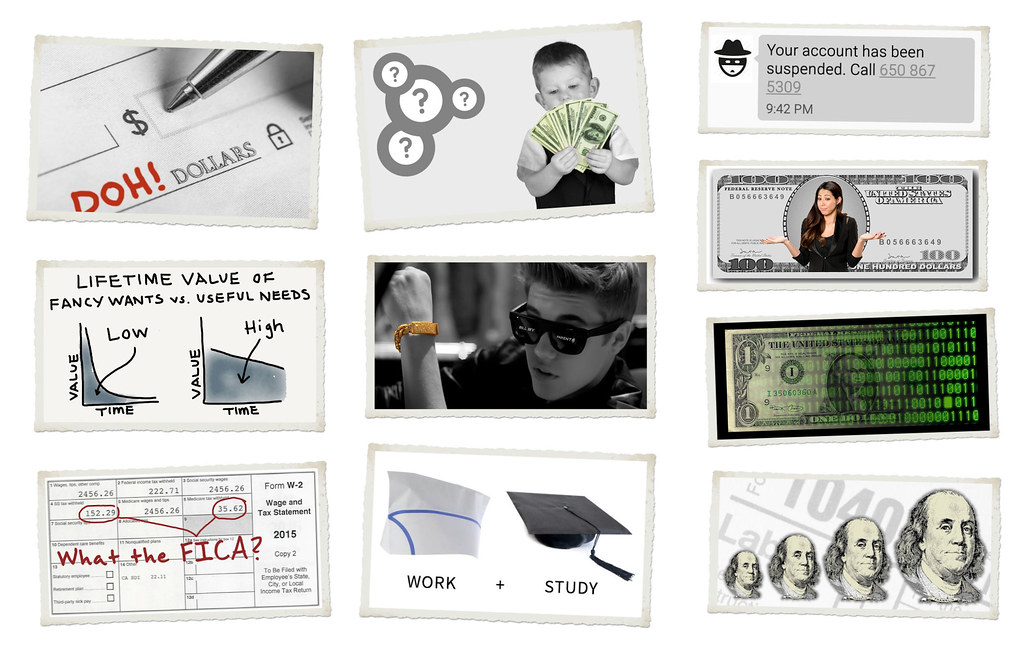

So, if you’re a Nickel prepaid card fan searching for a suitable and stable alternative, here’s how FamZoo stacks up:

Newer Posts

Newer Posts